📖 User Guides

🪙 How to create a token

- Go to POTLAUNCH and click on Token Creator in the navigation bar.

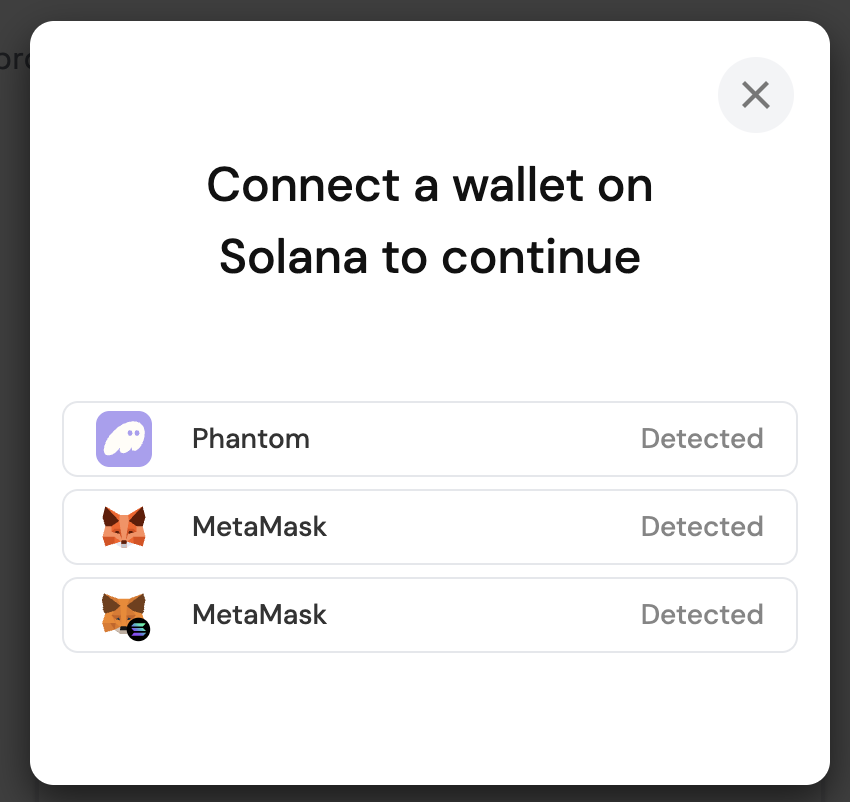

- 🦊 Connect your wallet (Connect Wallet).

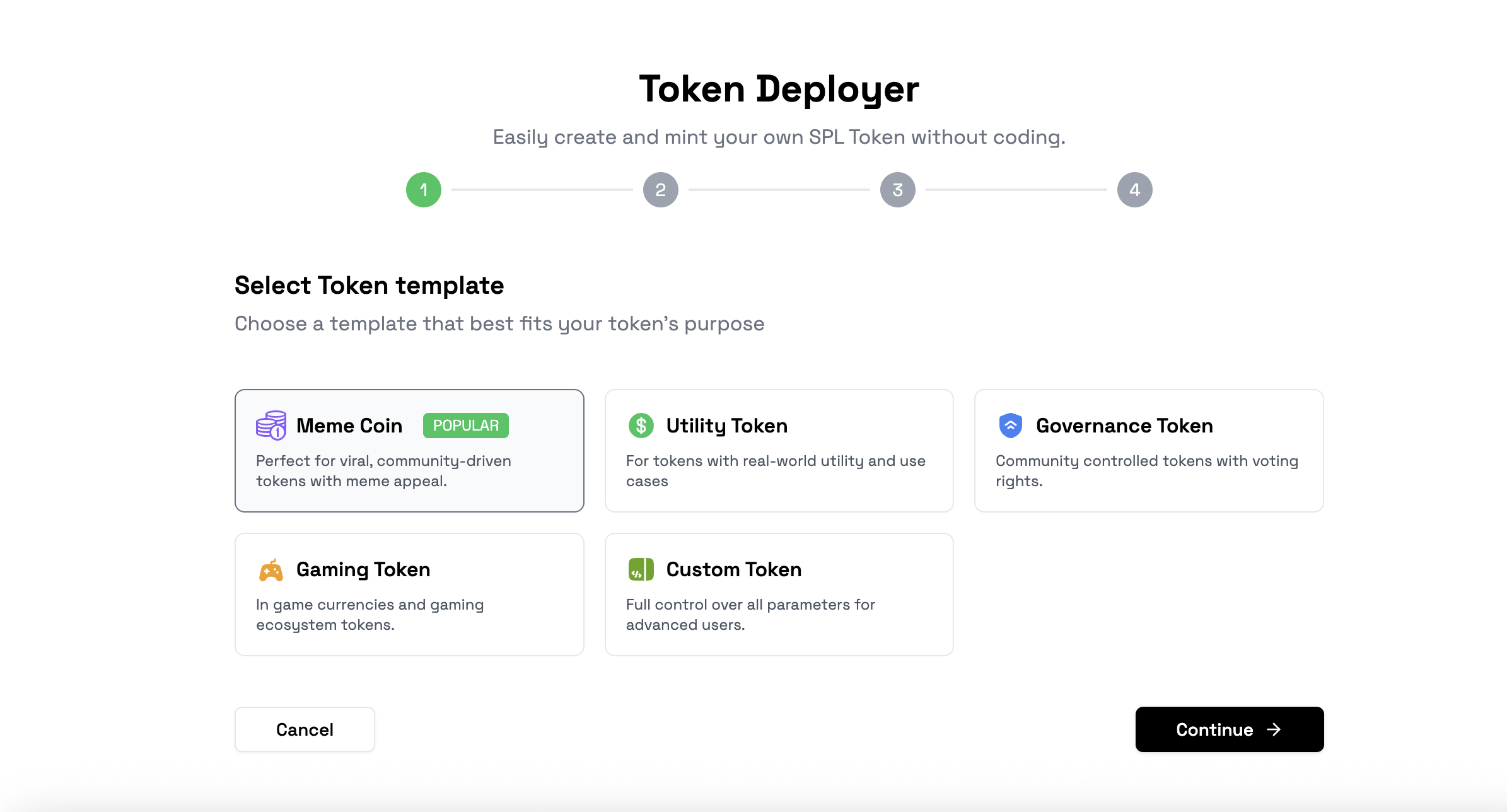

- 🧩 Select a token template that fits your purpose.

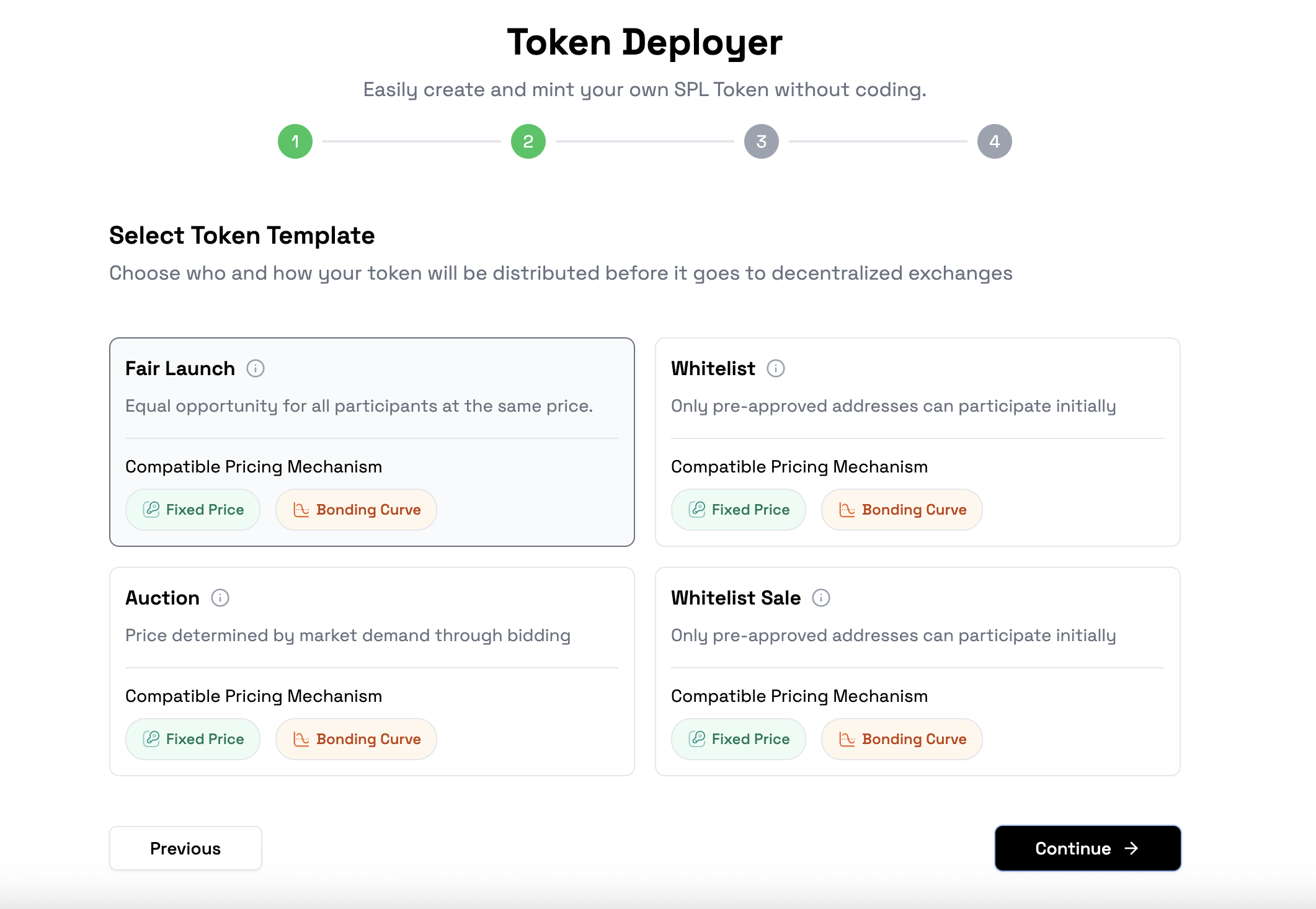

- 🔄 Select an exchange.

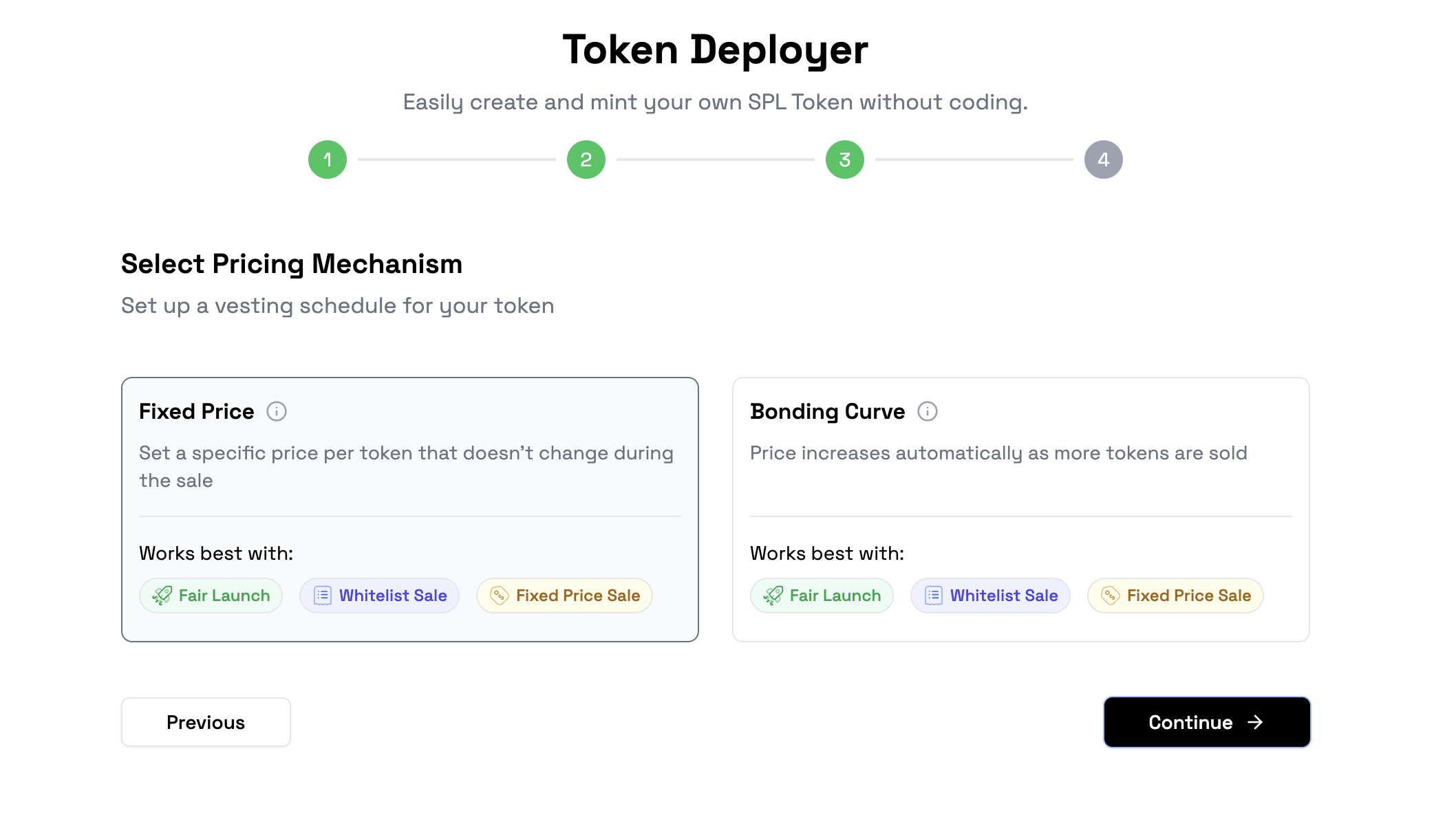

- 💸 Choose a pricing mechanism (Pricing Mechanism).

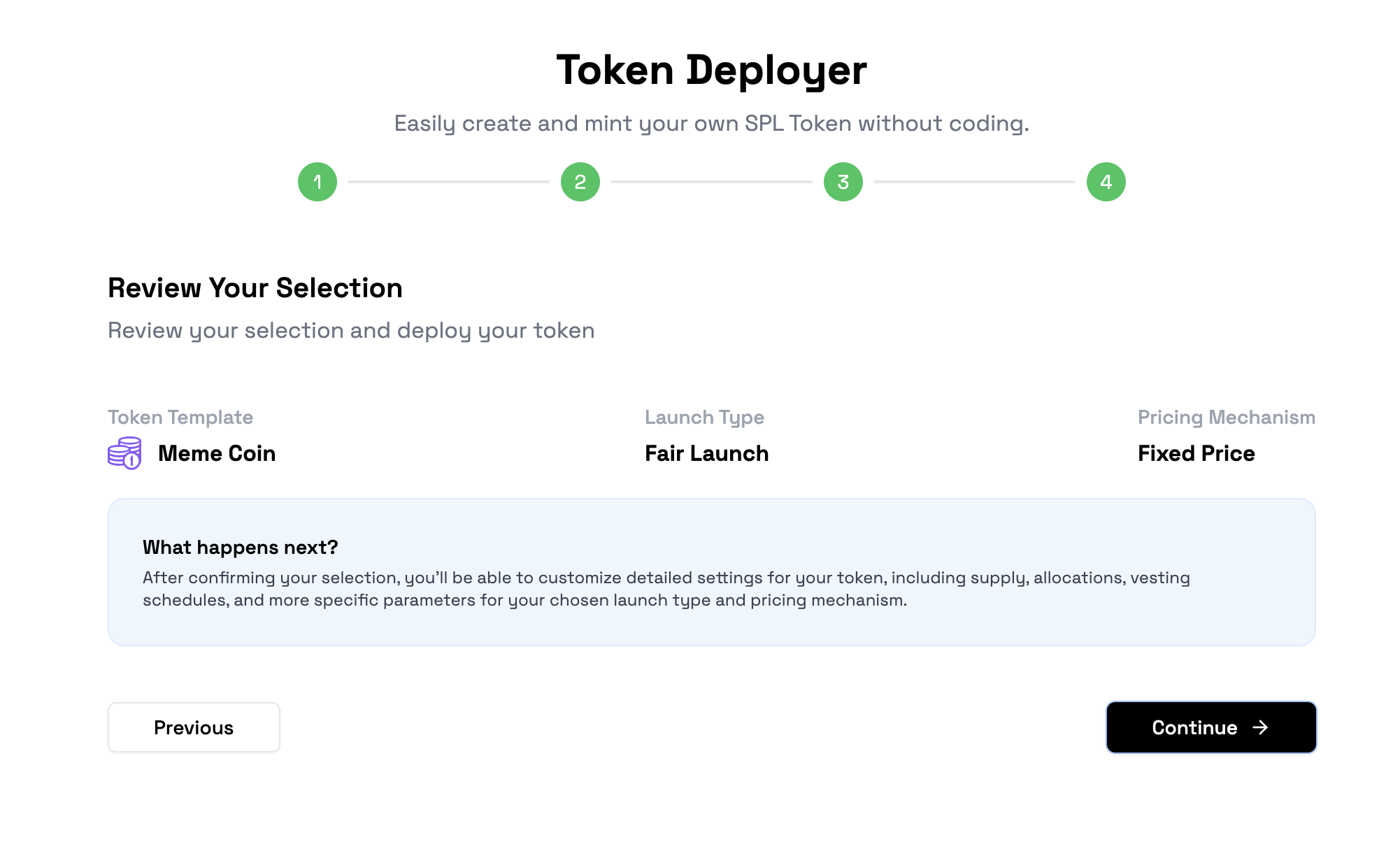

- 📝 Review your selection (Review Your Selection).

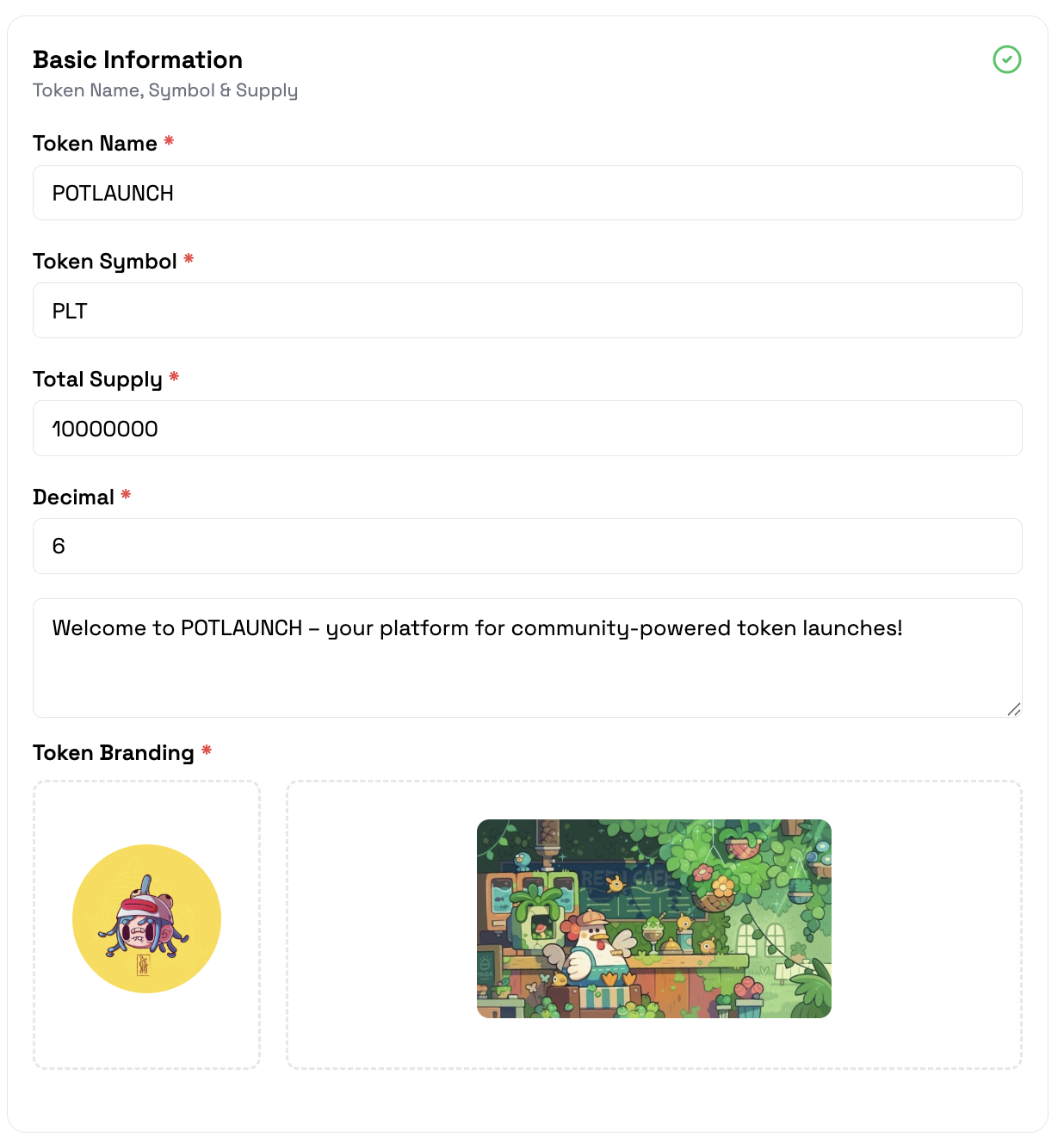

- 🏷️ Enter basic information: Name, symbol, total supply, description, logo, banner, etc.

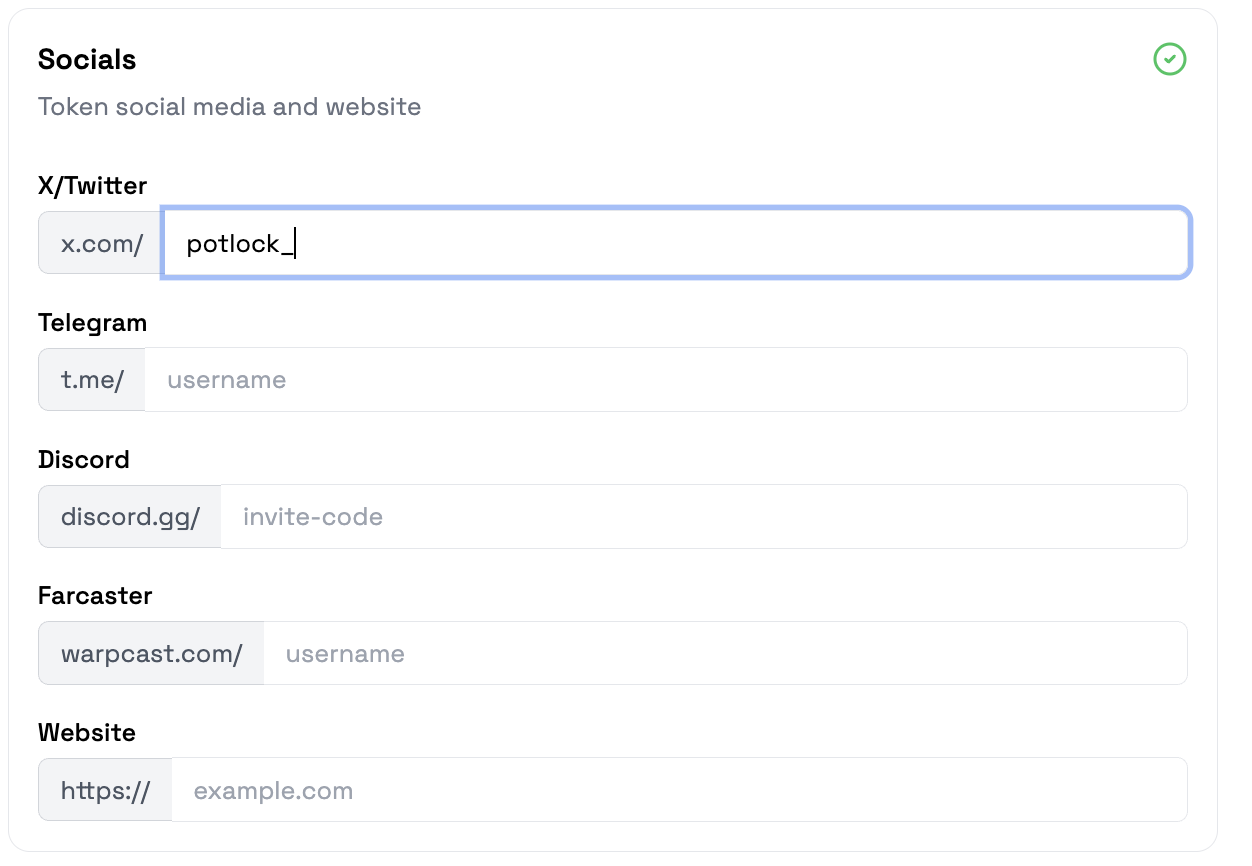

- 🌐 Add social links: Twitter, Telegram, Discord, Farcaster, Website, etc.

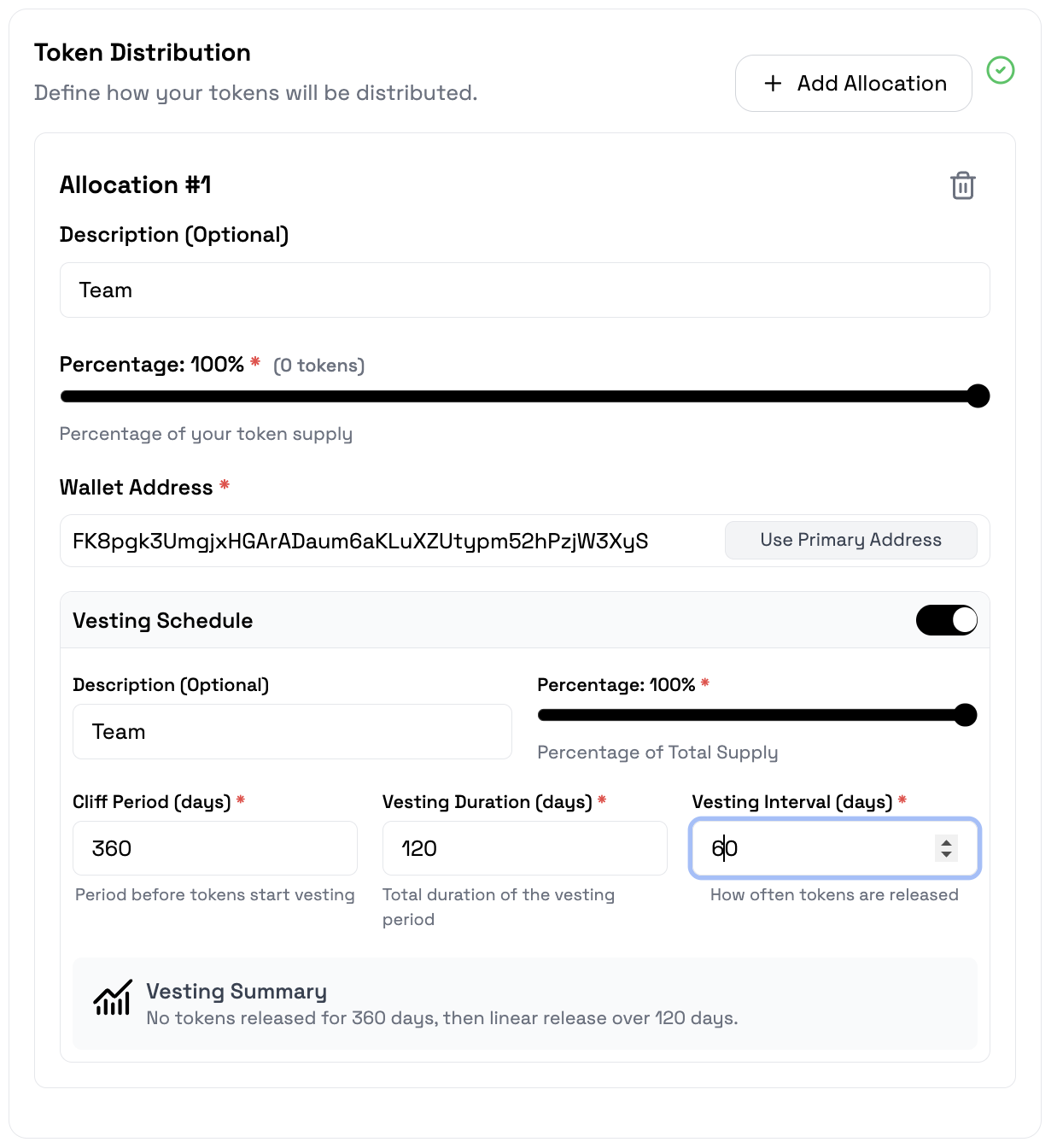

- 🎁 Set up token distribution: Add allocations, vesting if needed.

-

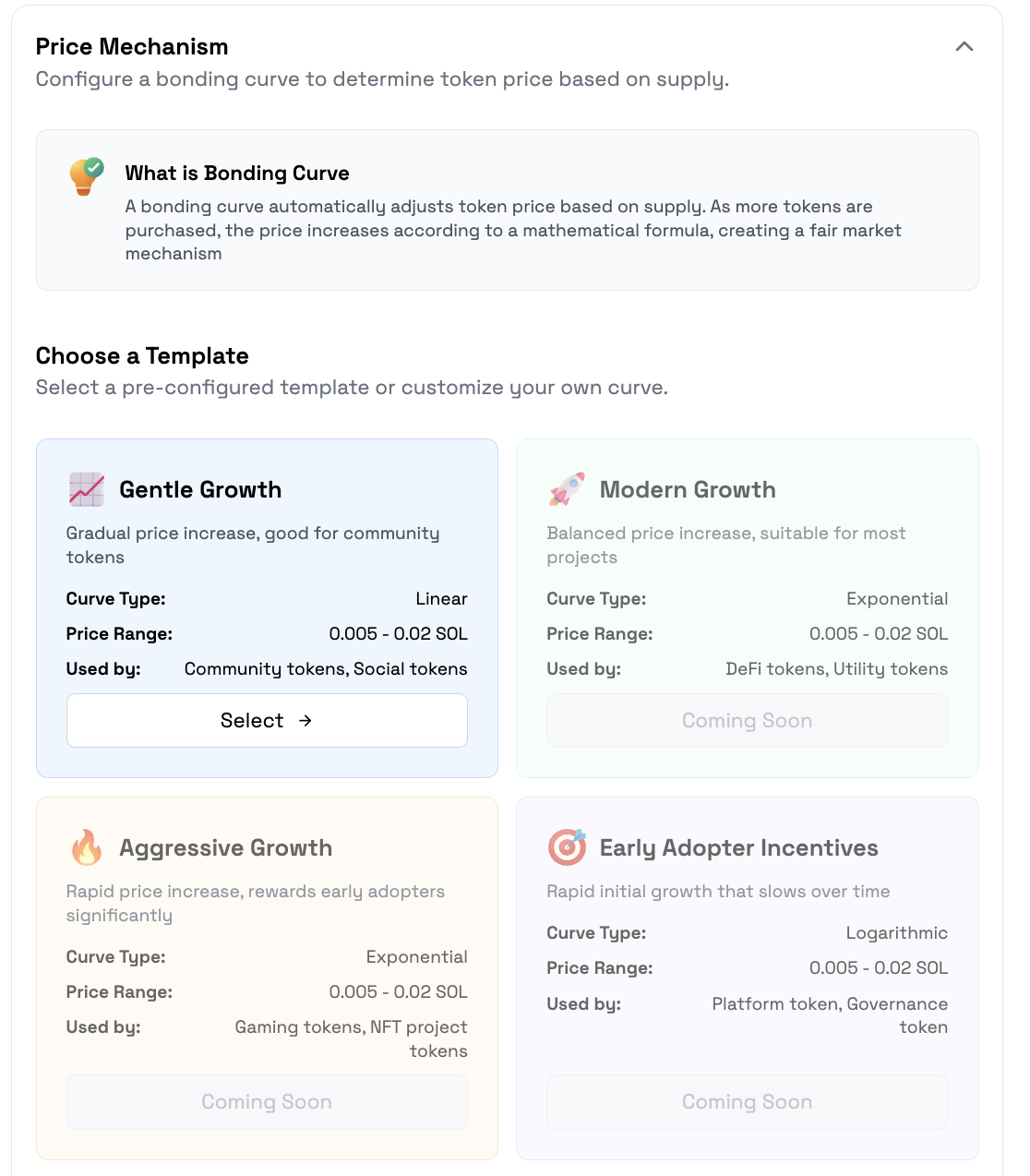

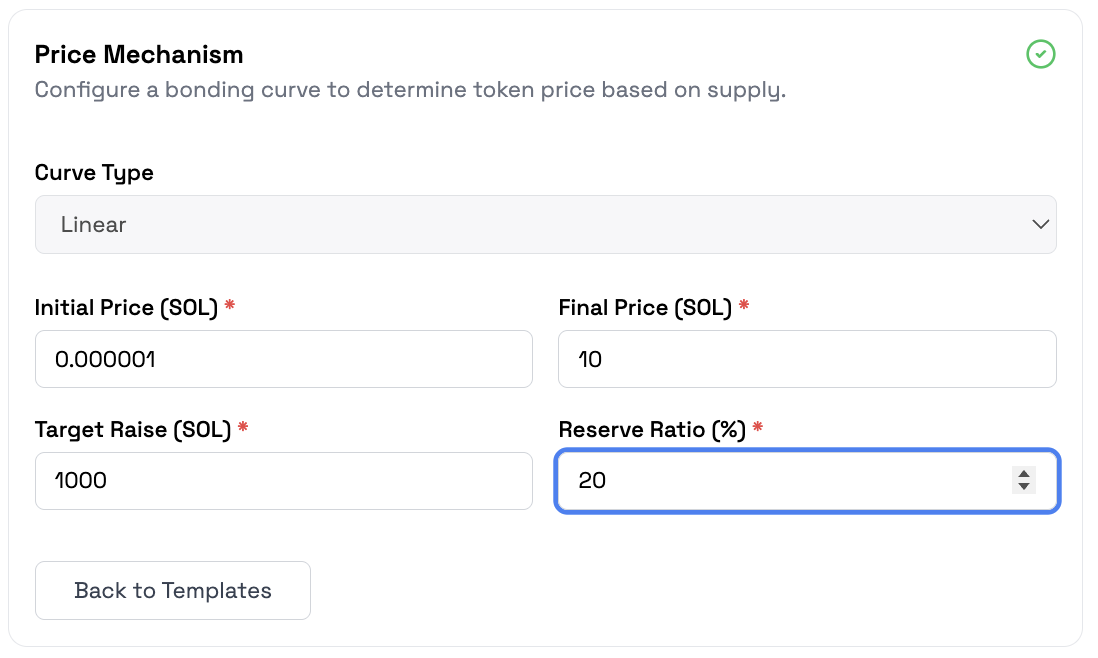

📈 Configure price mechanism: Bonding curve or fixed price.

- Select template price mechainsm

- Configure price mechainsm

-

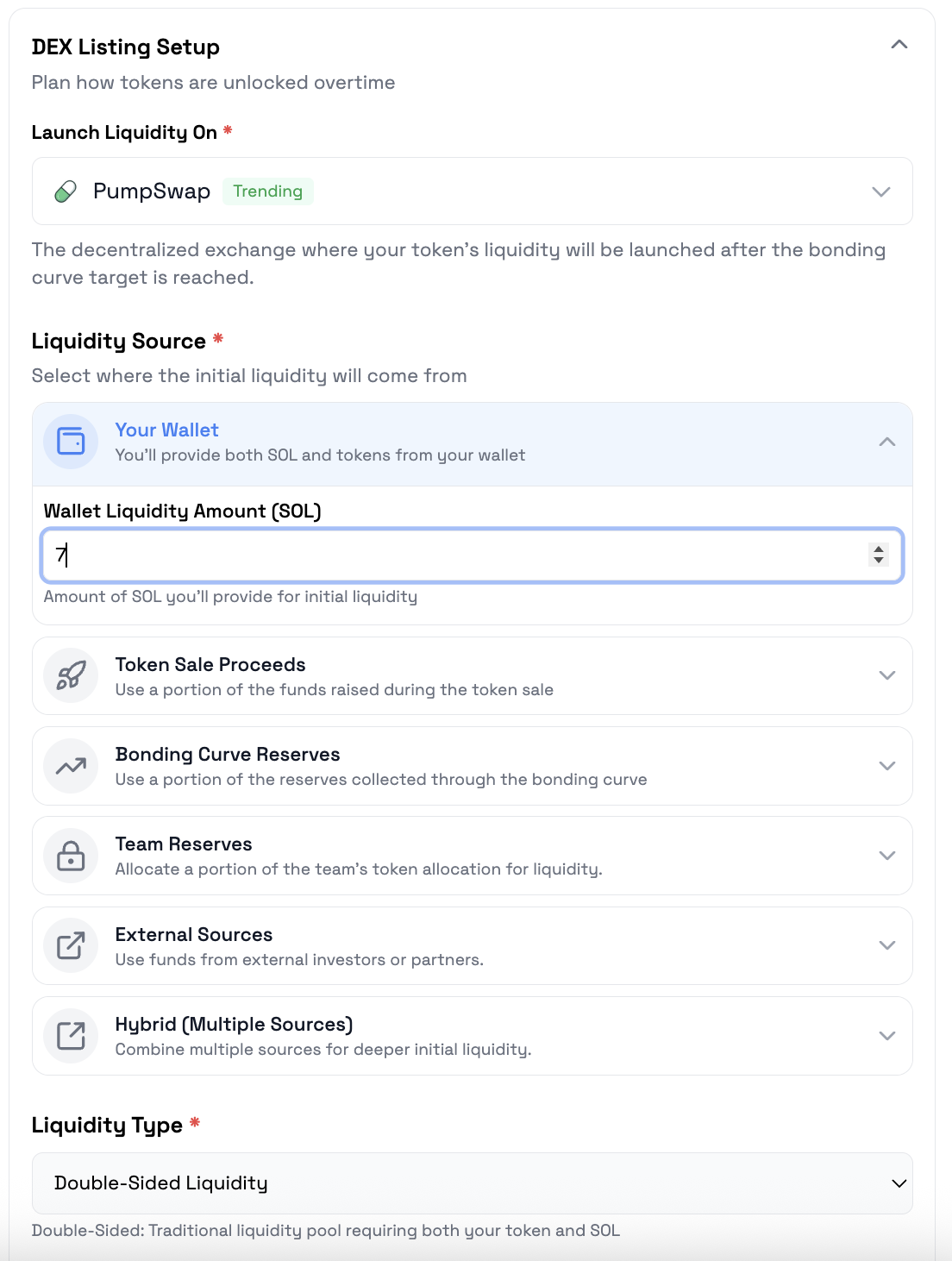

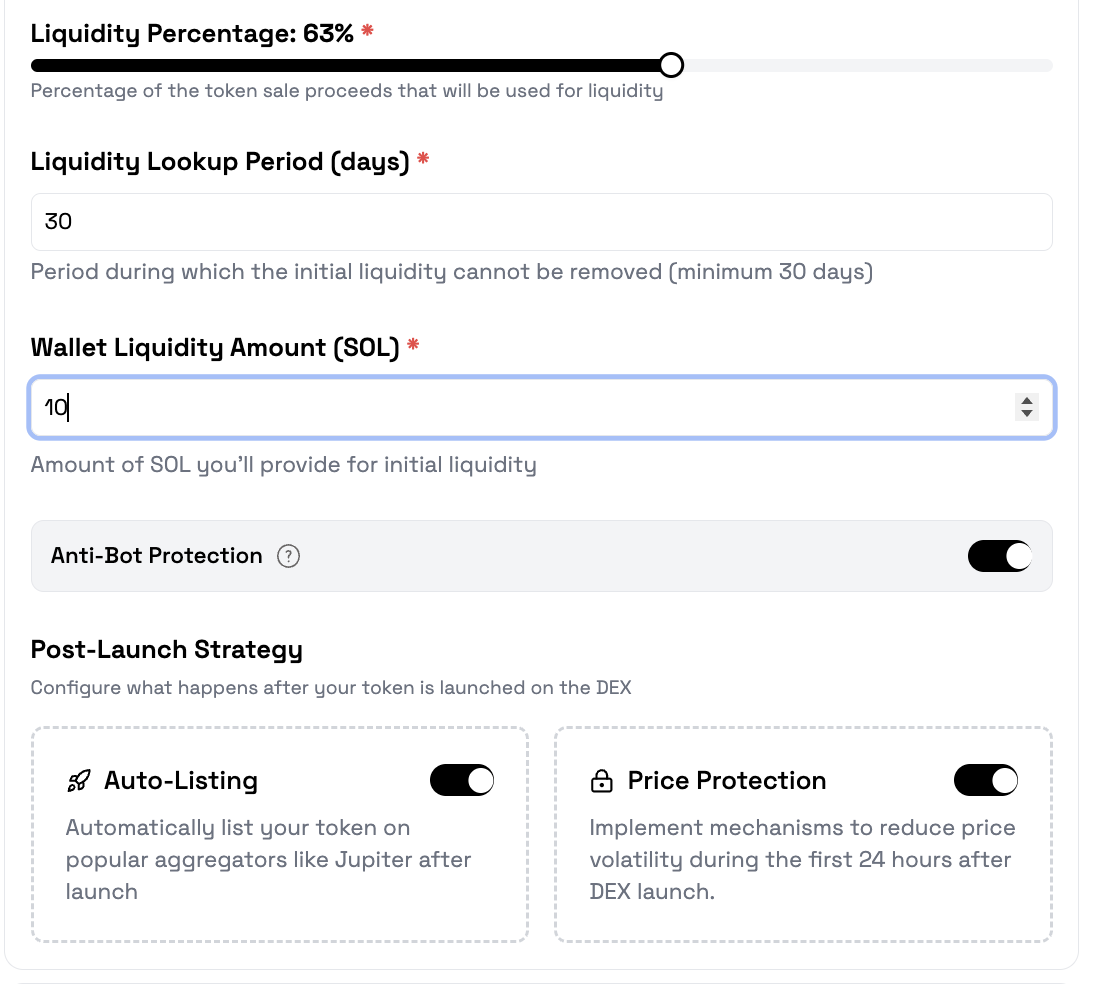

💧 Set up DEX listing: Choose DEX, liquidity source, SOL amount, etc.

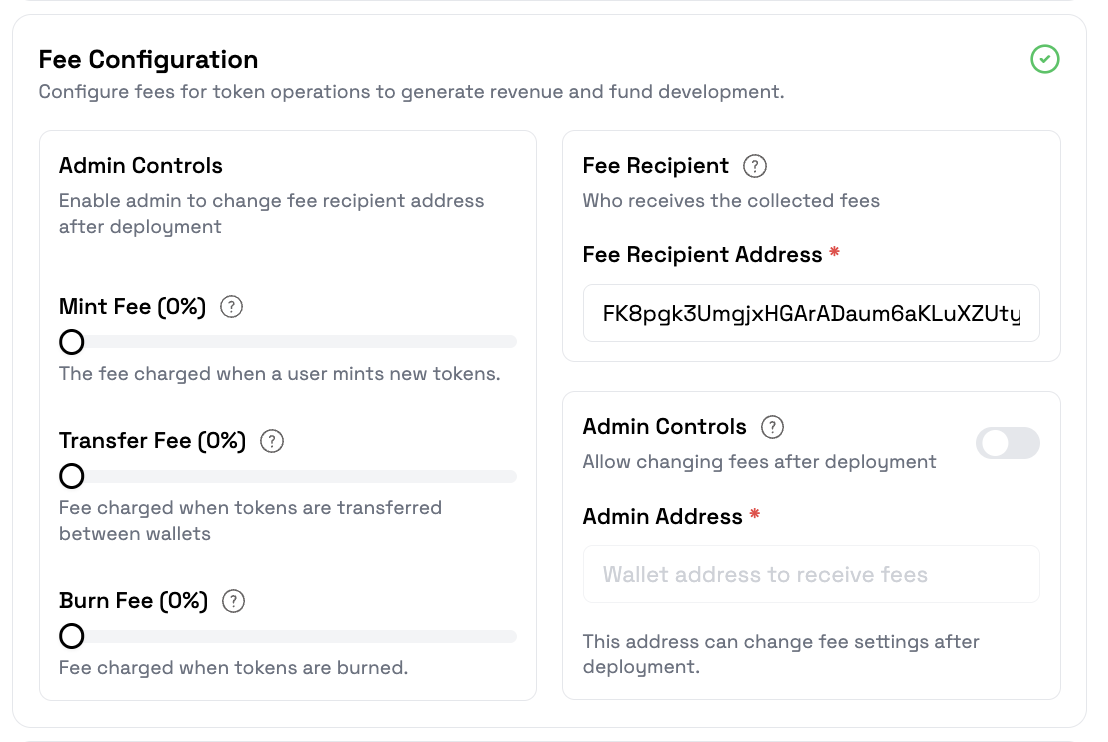

- 💰 Configure fees: Mint, transfer, burn fees, fee recipient address, etc.

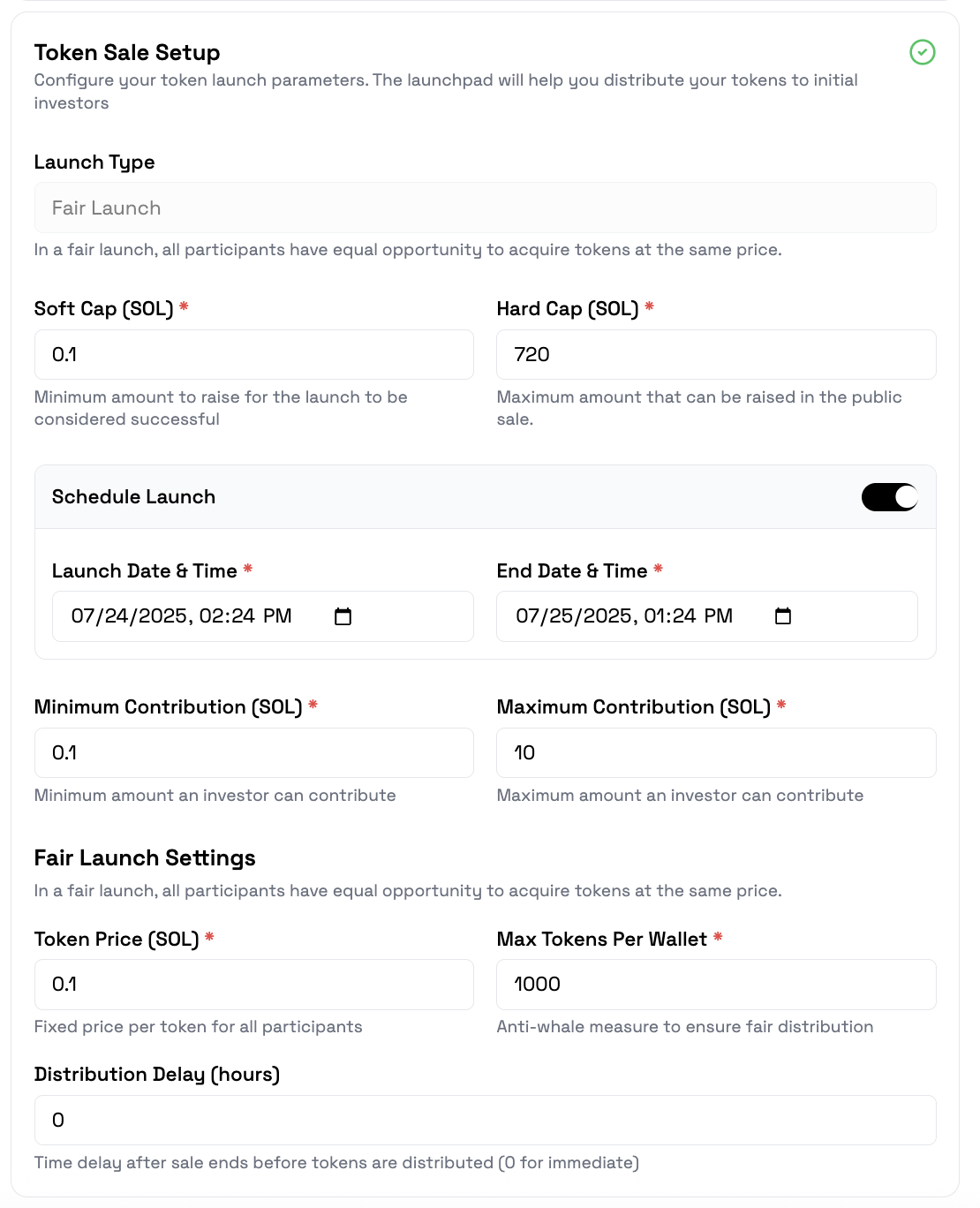

- 🚀 Set up token sale: Launch type, soft cap, hard cap, schedule, min/max contribution, etc.

-

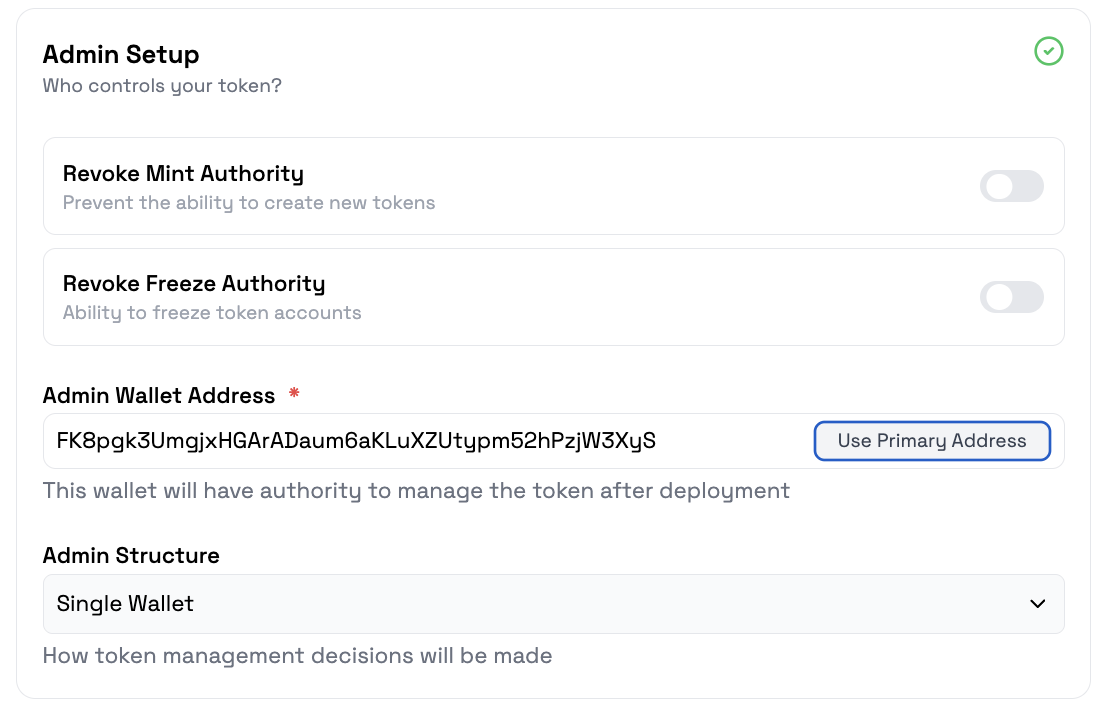

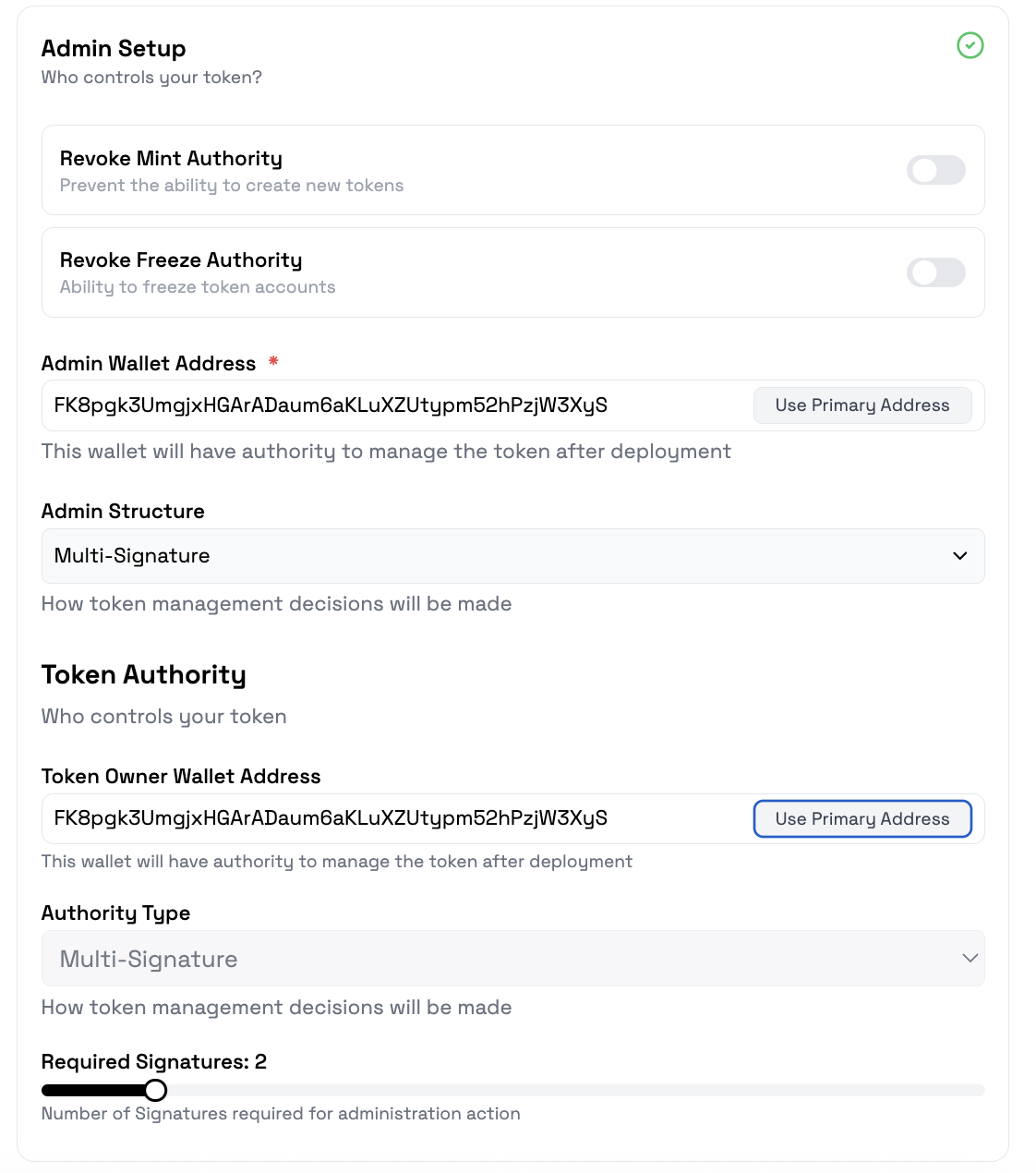

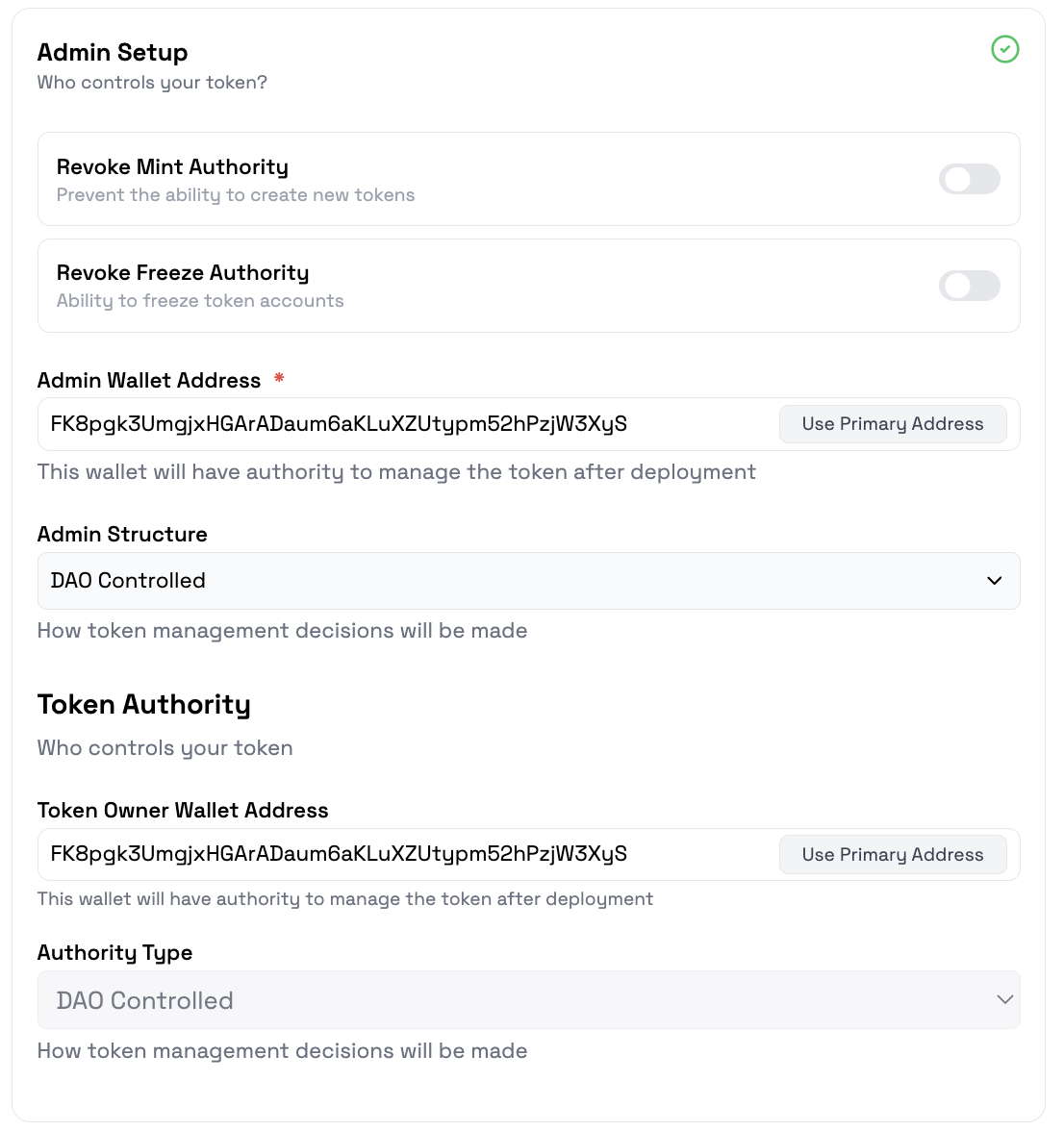

🛡️ Admin setup: Admin wallet address, admin structure, revoke mint/freeze authority, etc.

- Admin Structure: Single Wallet

- Admin Structure: Multi Signature

- Admin Structure: Dao Controlled

-

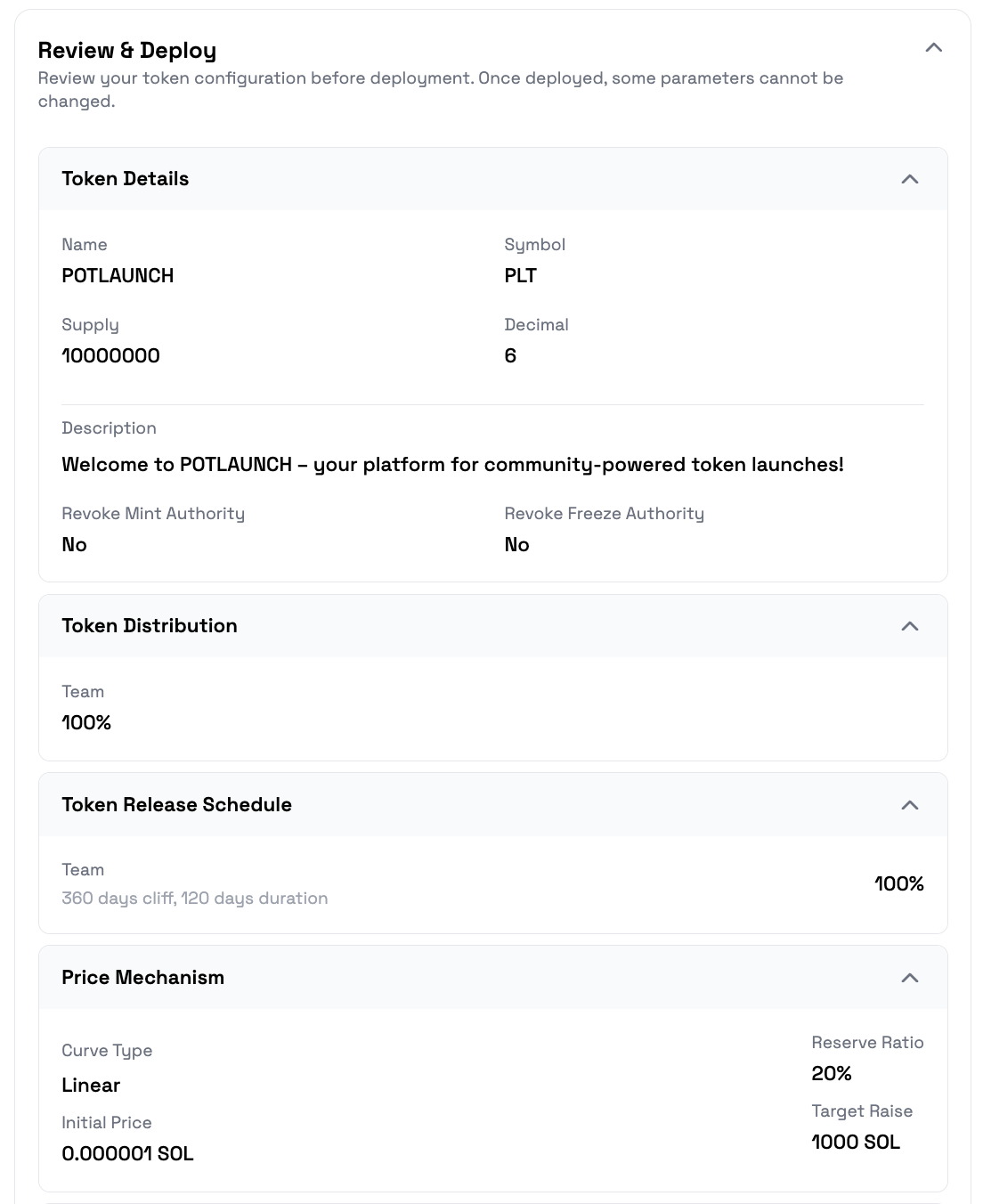

🔍 Review & deploy: Double-check all information.

-

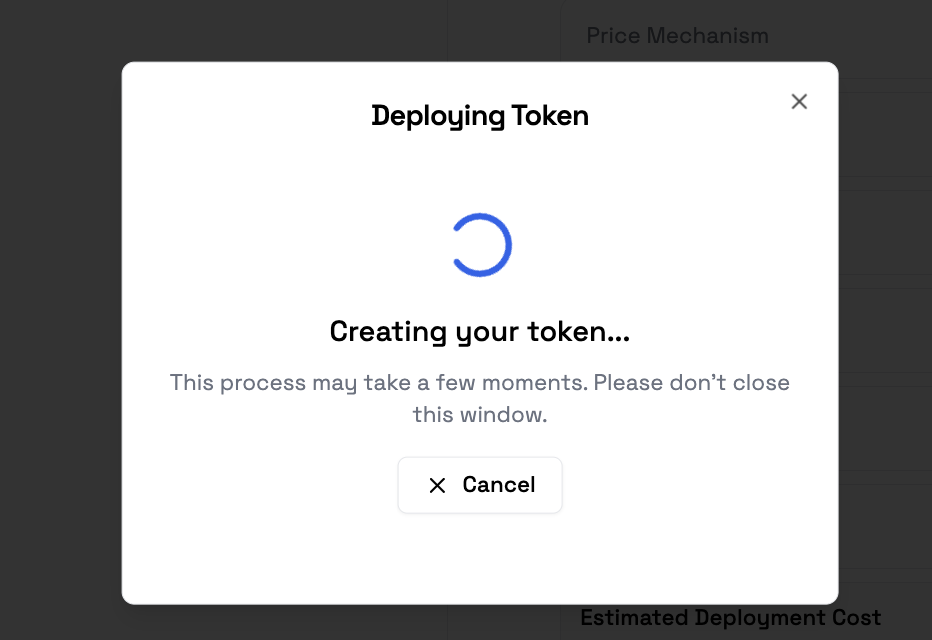

🟢 Deploy Token: Click Deploy to finish creating your token!

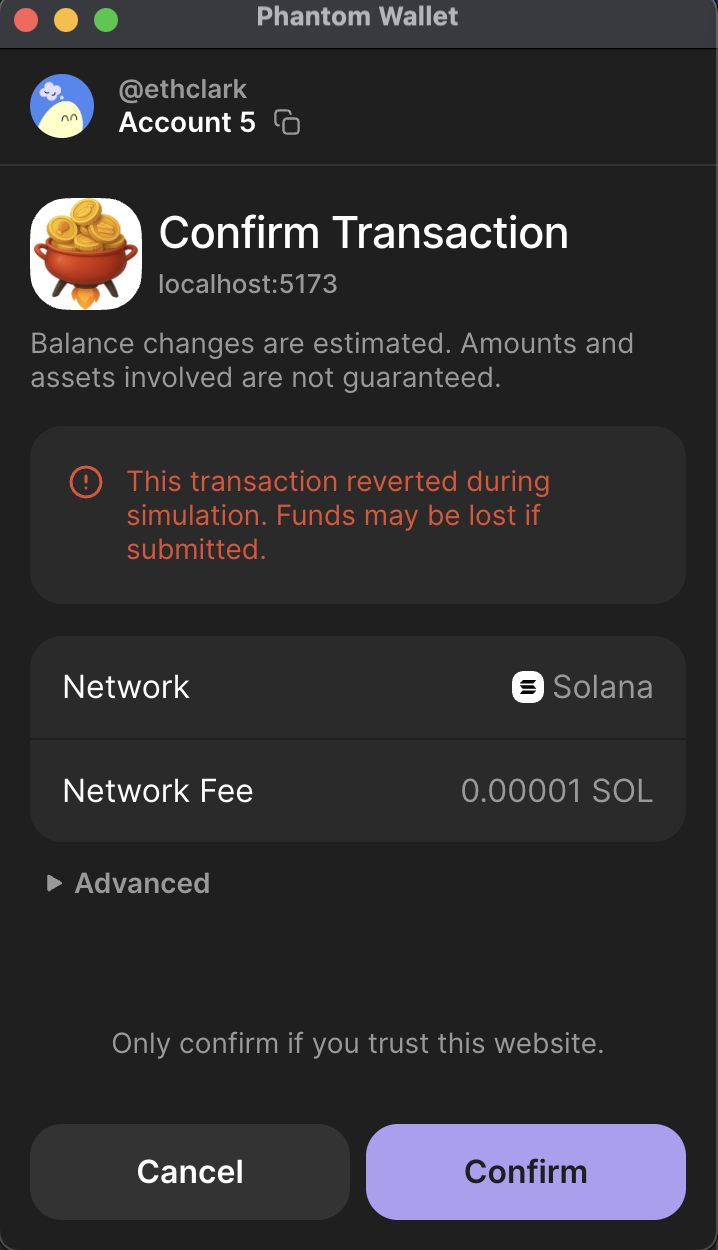

- When you click deploy token, a waiting pop-up like this will appear

- The last step is to confirm the transaction and you have successfully deployed.

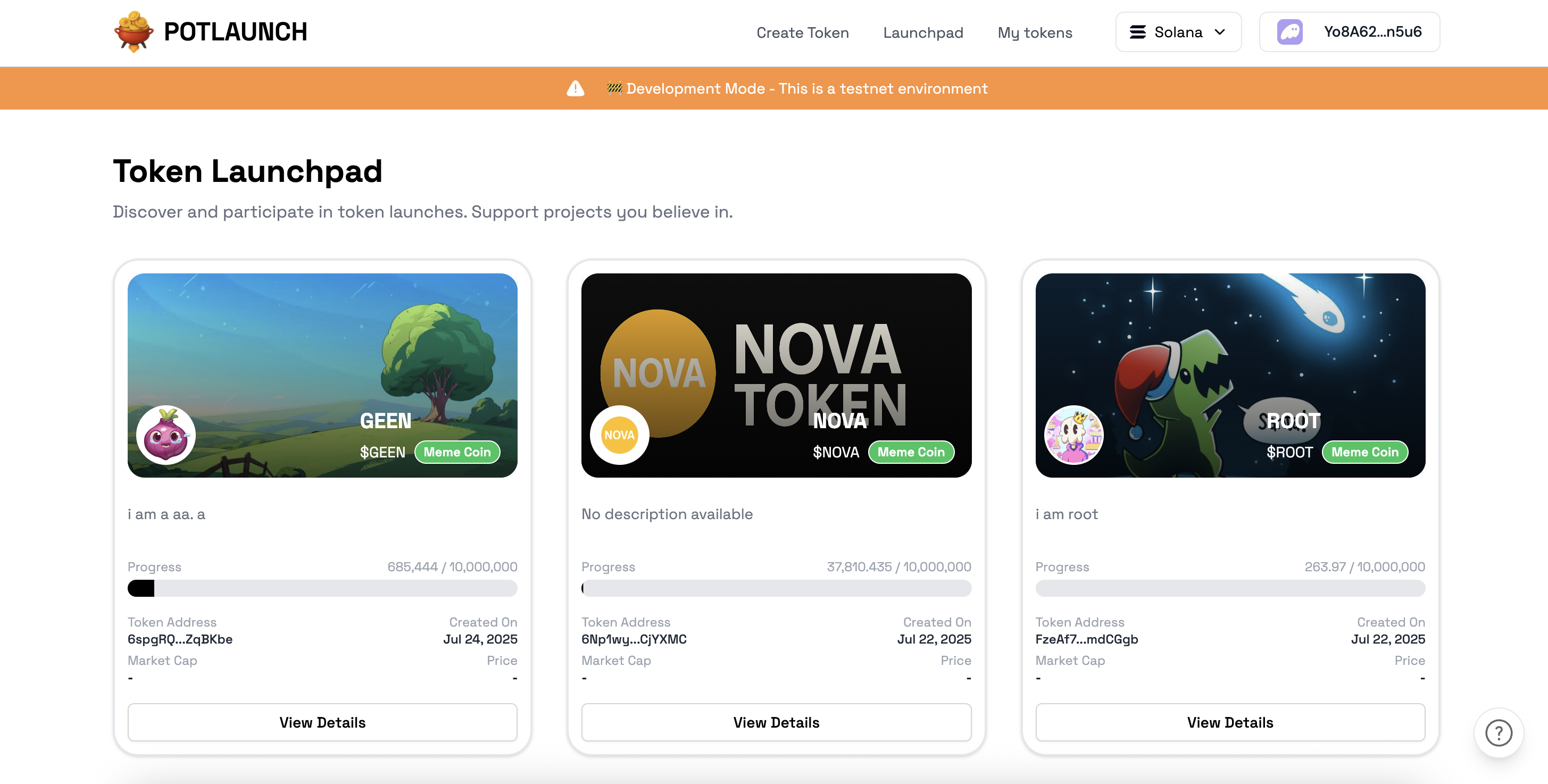

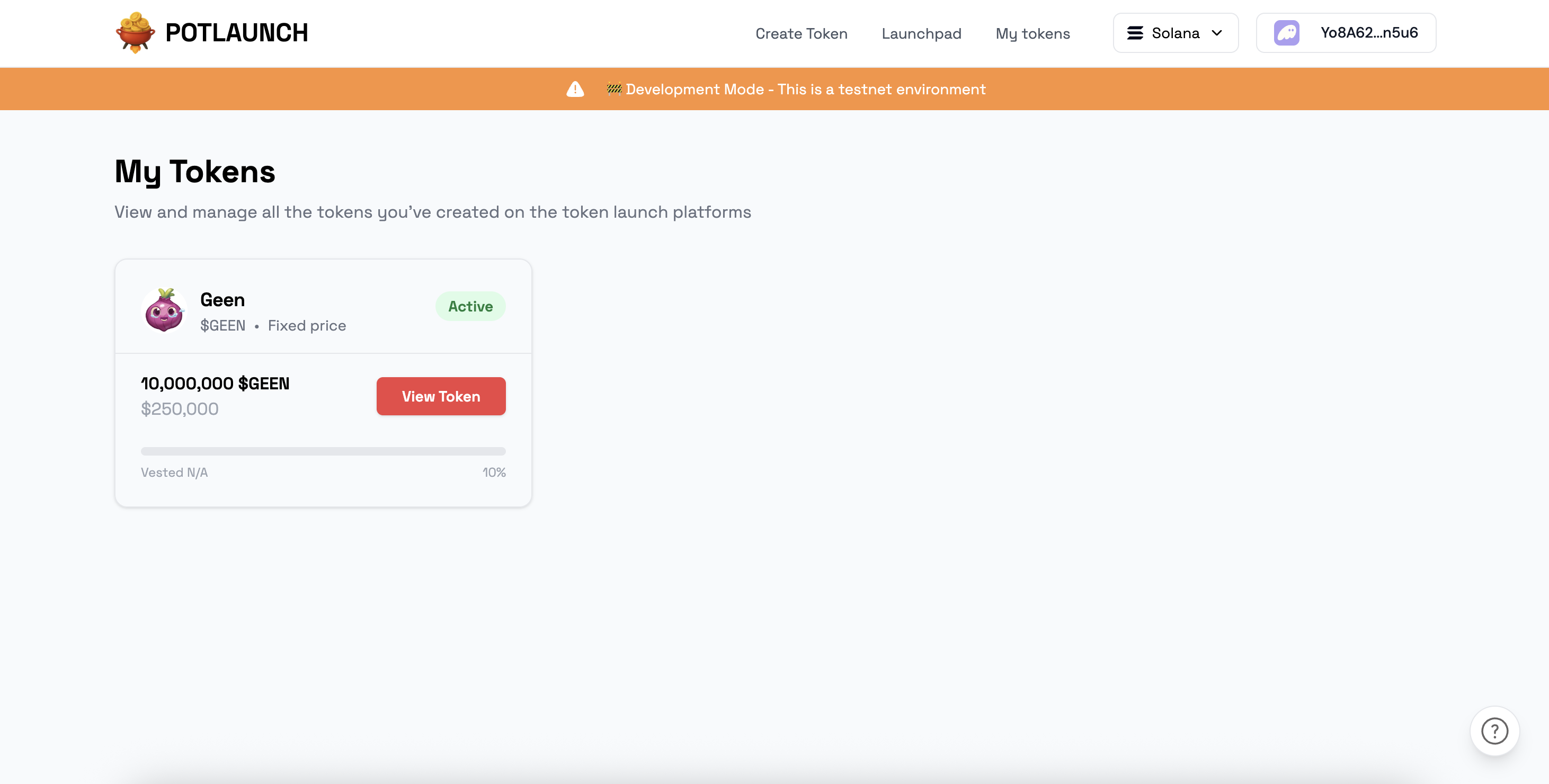

👀 Viewing existing tokens

- To see the tokens you have created, go to My Tokens.

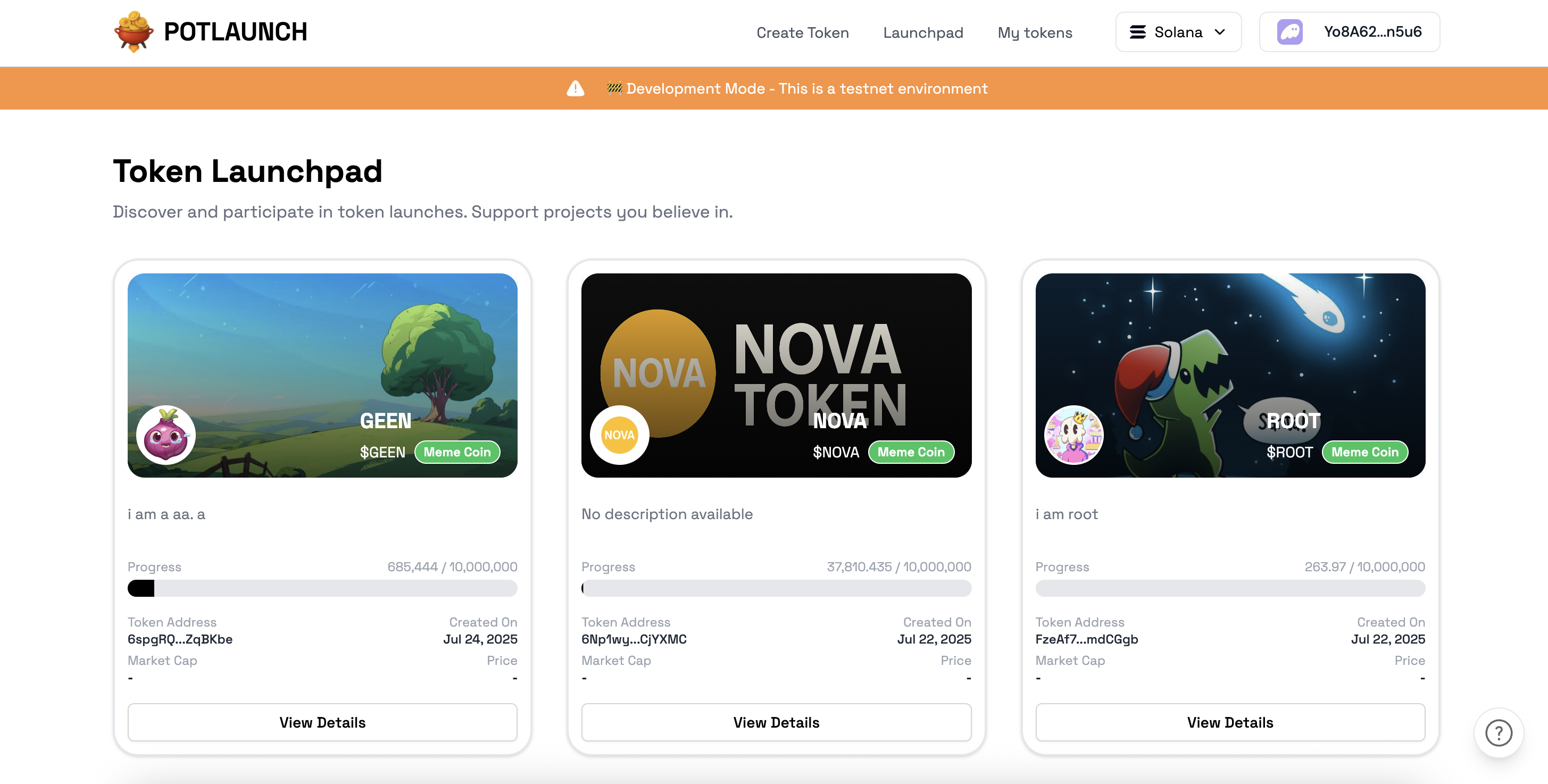

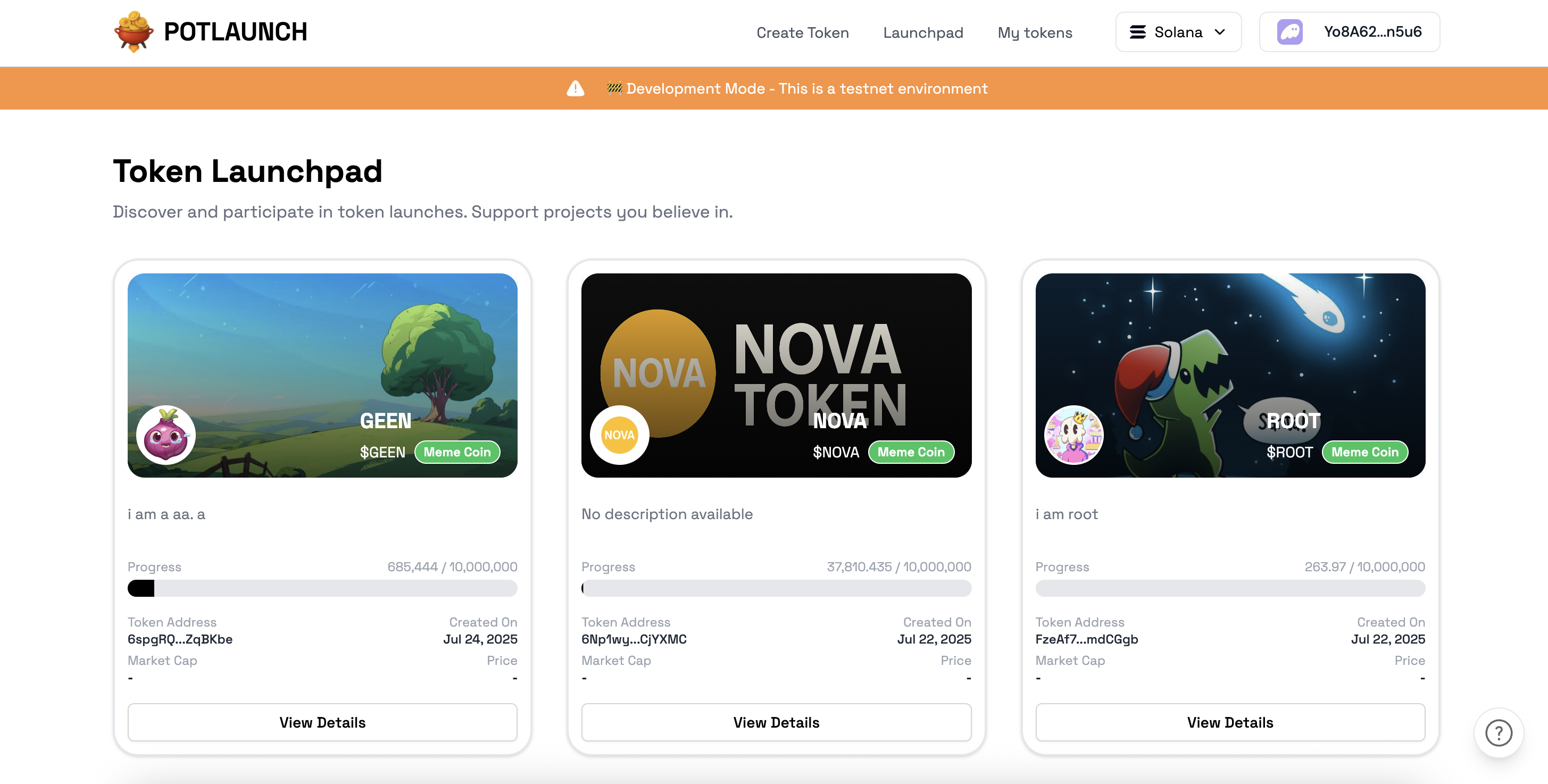

- To explore all tokens on the platform, visit the Token Launchpad.

Trading tokens on the platform

🛒 How to buy tokens

-

Navigate to the Token Launchpad

- Go to POTLAUNCH and click on Token Launchpad in the navigation bar.

- Browse through available tokens or search for specific tokens you're interested in.

-

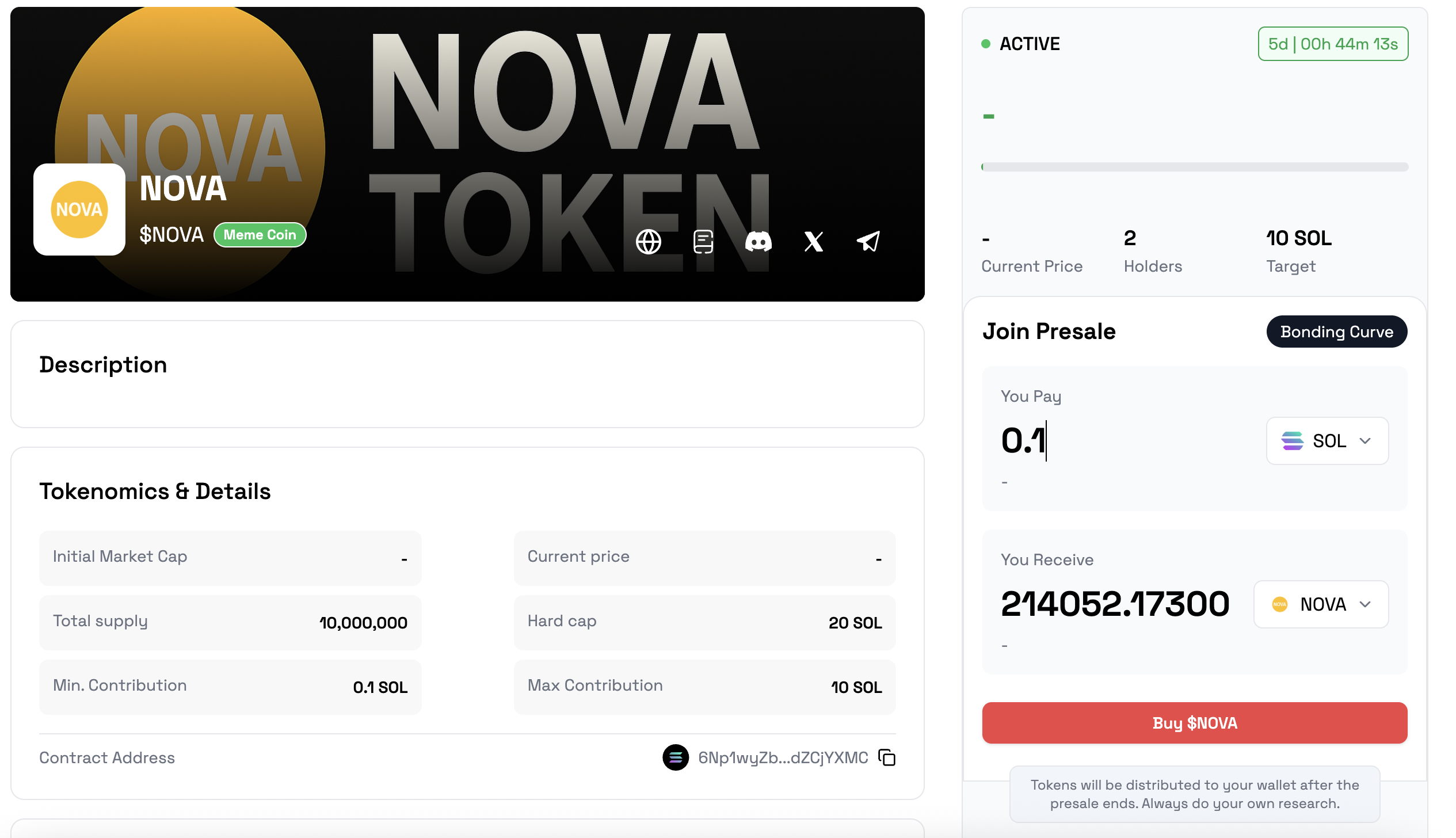

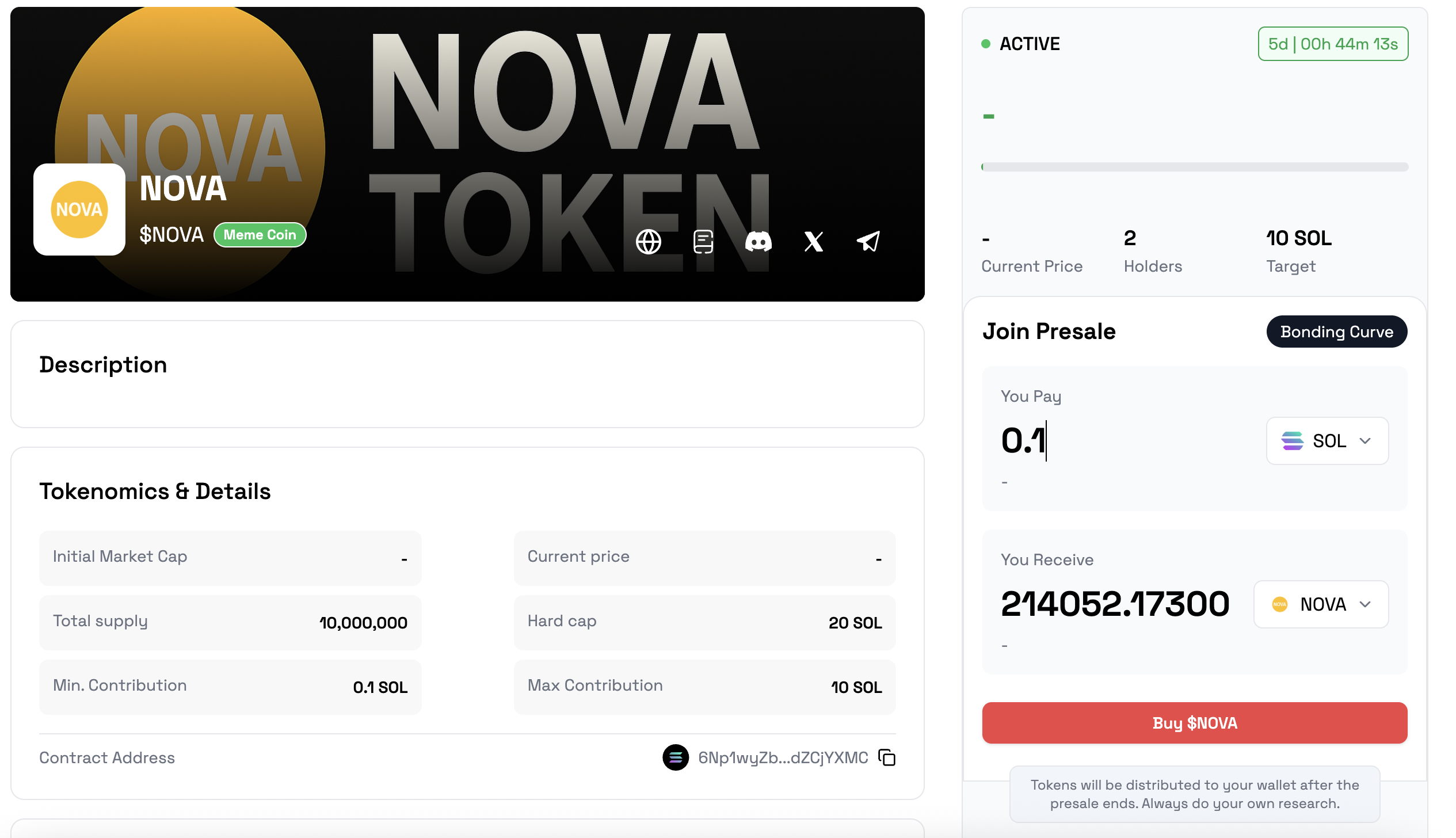

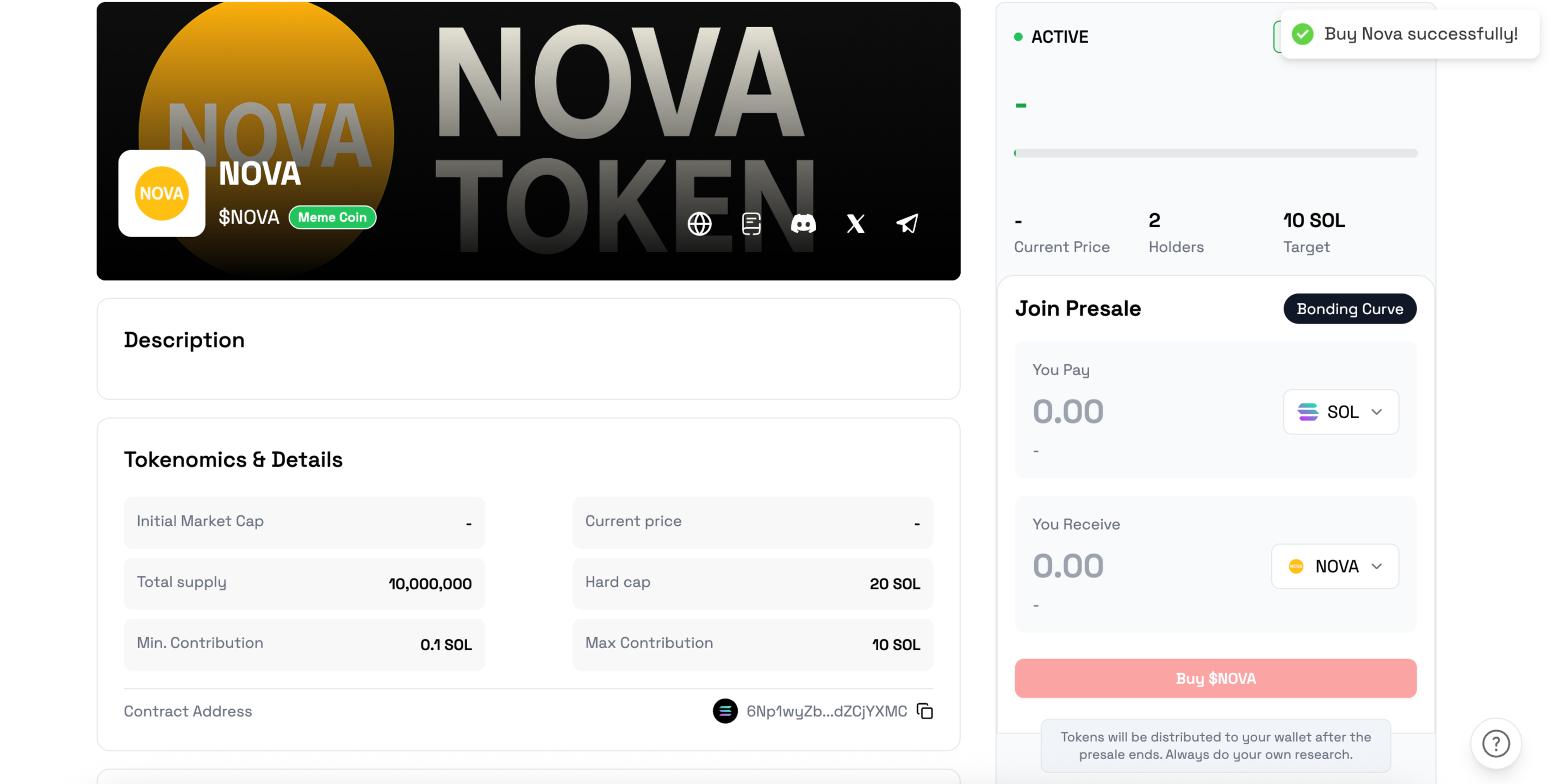

Select a token to trade

- Click on any token card to view its details, including:

- Token information (name, symbol, description)

- Current price and market cap

- Trading volume and liquidity

- Social links and community info

- Click on any token card to view its details, including:

-

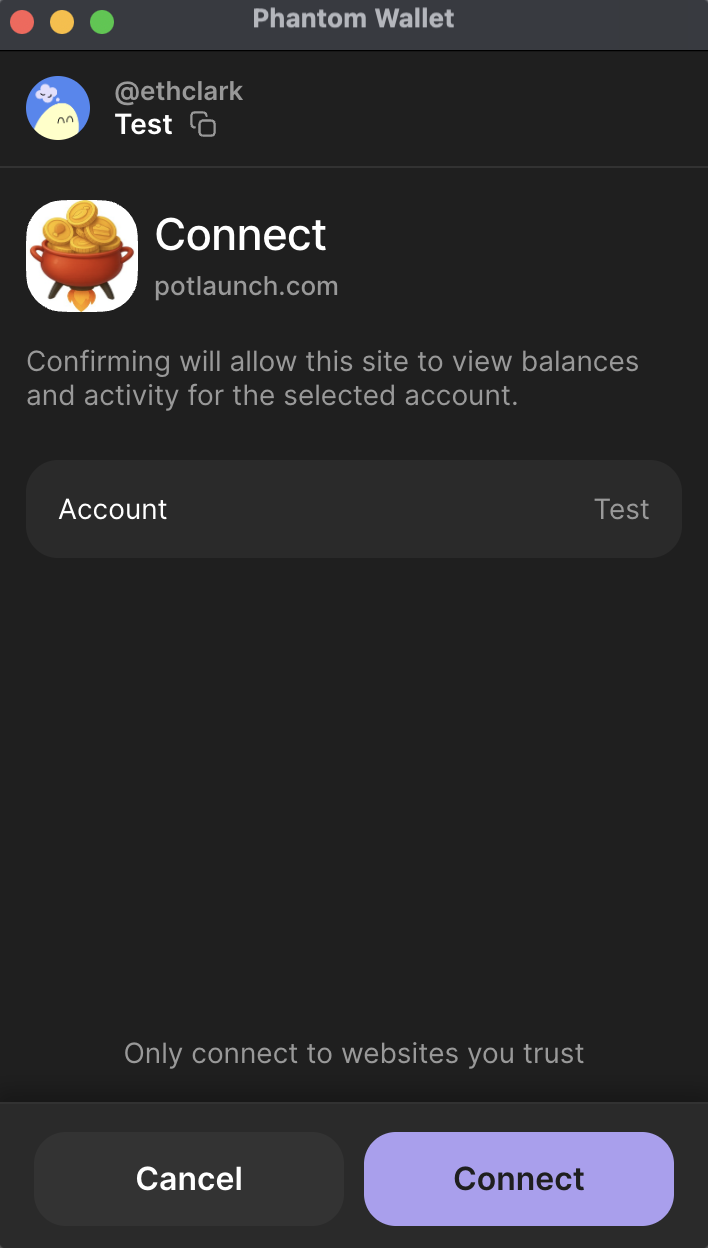

Connect your wallet

- Click the Connect Wallet button if you haven't already

- Choose your preferred wallet (Phantom, Solflare, etc.)

- Approve the connection request

-

Review token details

- Check the token's current price and market statistics

- Review the tokenomics and distribution

- Read the project description and social links

- Verify the liquidity and trading volume

-

Enter purchase amount

- In the trading interface, enter the amount of tokens you want to buy

- The platform will automatically calculate the total cost in SOL

- You can also enter the SOL amount and see how many tokens you'll receive

-

Review transaction details

- Double-check the token amount, price, and total cost

- Verify the transaction fees and slippage tolerance

- Ensure you have sufficient SOL balance for the purchase

-

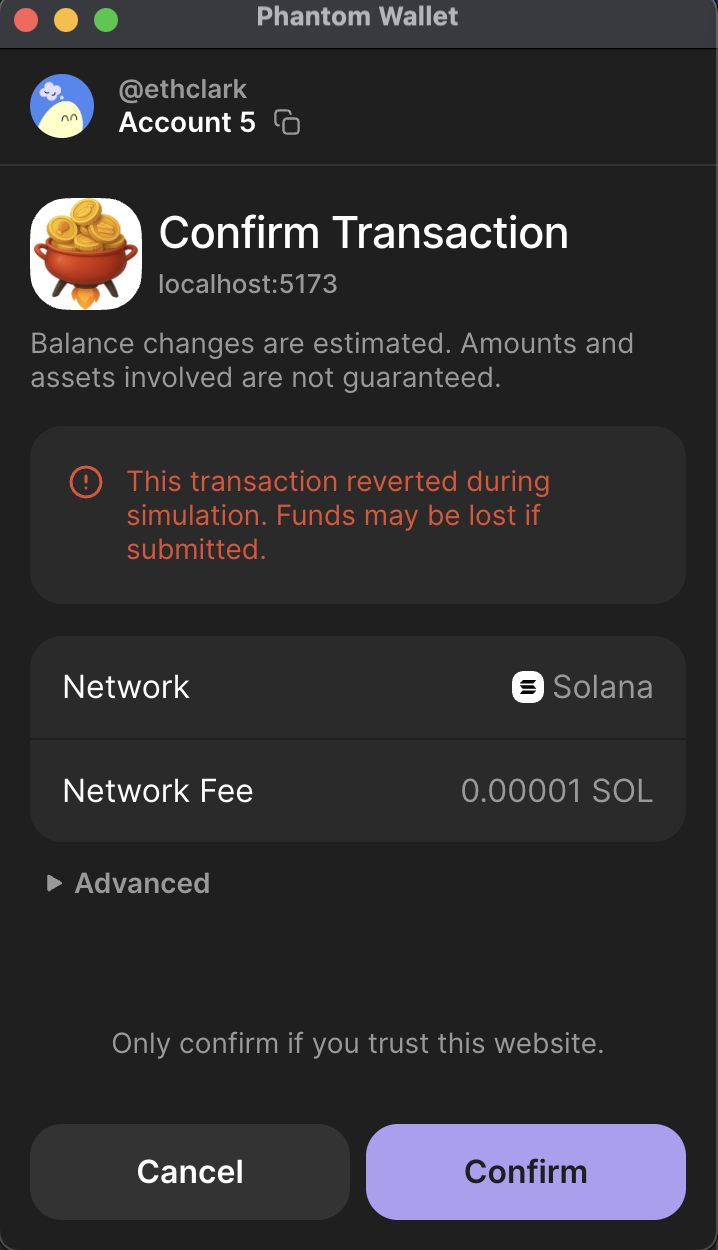

Confirm the transaction

- Click Buy Tokens or Confirm Purchase

- Your wallet will prompt you to approve the transaction

- Review the transaction details in your wallet

-

Wait for confirmation

- The transaction will be processed on the Solana blockchain

- You'll see a loading indicator during processing

- Wait for the transaction to be confirmed (usually takes a few seconds)

-

Transaction completed

- Once confirmed, you'll see a success message

- Your tokens will be automatically added to your wallet

- You can view your token balance in your wallet or on the platform

📊 How to sell tokens

-

Access the trading interface

- Go to the token's trading page

- Click on the Sell tab or toggle to sell mode

-

Enter sell amount

- Specify how many tokens you want to sell

- The platform will show the SOL amount you'll receive

- Consider the current market price and liquidity

-

Review and confirm

- Check the exchange rate and fees

- Confirm the transaction in your wallet

- Wait for the transaction to be processed

💡 Trading Tips

- Always DYOR (Do Your Own Research): Research the project, team, and tokenomics before investing

- Check liquidity: Ensure there's sufficient liquidity for smooth trading

- Monitor slippage: Be aware of price impact, especially for large orders

- Use limit orders: Consider using limit orders for better price control

- Keep track of fees: Account for transaction fees and platform fees

- Secure your wallet: Never share your private keys and use hardware wallets for large amounts

🔍 Viewing your portfolio

- My Tokens: View all tokens you've created or purchased

- Transaction History: Track all your buy/sell transactions

- Portfolio Value: Monitor your total portfolio value and performance

- Price Alerts: Set up notifications for price movements

Understanding token economics

🏗️ What are token economics?

Token economics (tokenomics) refers to the economic model and design of a cryptocurrency or token. It encompasses all the factors that influence a token's value and utility, including supply, demand, distribution, and governance mechanisms.

📊 Key token economics concepts

Token Supply

- Total Supply: The maximum number of tokens that will ever exist

- Circulating Supply: Tokens currently available in the market

- Locked Supply: Tokens held in vesting schedules or smart contracts

- Burned Supply: Tokens permanently removed from circulation

Token Distribution

- Team & Advisors: Usually 10-20% with vesting schedules

- Community & Public Sale: 30-50% for fair distribution

- Liquidity: 10-20% for DEX liquidity pools

- Marketing & Development: 5-15% for ongoing operations

- Reserve: 5-10% for future development

Vesting Schedules

- Linear Vesting: Tokens unlock gradually over time

- Cliff Vesting: No tokens until a specific date, then gradual release

- Milestone Vesting: Tokens unlock based on project achievements

💰 Pricing Mechanisms on POTLAUNCH

Bonding Curve Pricing

- How it works: Price increases as more tokens are sold

- Formula: Price = Base Price × (1 + Supply Sold / Total Supply)^Curve Exponent

- Benefits:

- Fair price discovery

- No manipulation

- Continuous liquidity

- Example: Early buyers get better prices, later buyers pay more

Fixed Price Sales

- How it works: All tokens sold at the same price

- Benefits:

- Predictable pricing

- Simple to understand

- Fair for all participants

- Use cases: Initial token sales, private rounds

Dutch Auctions

- How it works: Price starts high and decreases until all tokens are sold

- Benefits:

- Market-driven pricing

- Efficient price discovery

- Prevents FOMO buying

- Example: Price starts at 1 SOL, decreases by 0.01 SOL every hour

🔄 Token Utility & Value Drivers

Utility Functions

- Governance: Voting rights on protocol decisions

- Staking: Earn rewards by locking tokens

- Access: Exclusive features or services

- Payment: Use tokens for platform fees

- Rewards: Earn tokens for participation

Value Drivers

- Scarcity: Limited supply increases value

- Demand: Growing user base and adoption

- Utility: Real-world use cases

- Network Effects: More users = more value

- Speculation: Future potential and hype

📈 Market Dynamics

Supply & Demand

- Bull Market: High demand, increasing prices

- Bear Market: Low demand, decreasing prices

- Equilibrium: Supply meets demand at stable price

Liquidity

- High Liquidity: Easy to buy/sell without price impact

- Low Liquidity: Large trades cause significant price movement

- Liquidity Pools: Automated market makers provide continuous trading

Volatility

- High Volatility: Large price swings, higher risk/reward

- Low Volatility: Stable prices, lower risk

- Factors: Market sentiment, news, whale activity

🎯 Token Launch Strategies

Fair Launch

- No pre-mine: All tokens available to public

- Equal opportunity: Same price for everyone

- Community-driven: Decentralized decision making

- Benefits: Trust, fairness, community ownership

Vested Launch

- Team tokens: Locked for 1-4 years

- Advisor tokens: Gradual release over time

- Community tokens: Immediate access

- Benefits: Aligns incentives, prevents dumping

Tiered Launch

- Whitelist: Priority access for early supporters

- Public sale: Open to everyone

- DEX listing: Continuous trading after launch

- Benefits: Rewards early supporters, fair distribution

💡 Best Practices for Token Economics

Design Principles

- Sustainability: Long-term viability over short-term gains

- Fairness: Equal opportunity for all participants

- Transparency: Clear tokenomics and vesting schedules

- Utility: Real value beyond speculation

- Security: Protection against manipulation

Common Mistakes to Avoid

- Too much supply: Dilutes value and reduces scarcity

- Poor distribution: Concentrates wealth in few hands

- No utility: Pure speculation without real use cases

- Unrealistic vesting: Too short or too long lock periods

- Lack of transparency: Hidden tokenomics or unclear rules

Success Factors

- Strong community: Engaged and active user base

- Clear roadmap: Defined development milestones

- Regular updates: Transparent communication

- Market timing: Launch during favorable conditions

- Partnerships: Strategic collaborations and integrations

🔍 Analyzing Token Economics

Key Metrics to Watch

- Market Cap: Total value of all tokens

- Fully Diluted Valuation (FDV): Value if all tokens were circulating

- Price to Sales Ratio: Token price relative to platform revenue

- Holder Distribution: How tokens are distributed among addresses

- Trading Volume: Daily trading activity

Red Flags

- Concentrated ownership: Few addresses hold most tokens

- No vesting: Team can dump immediately

- Unrealistic promises: Too good to be true returns

- Lack of transparency: Hidden tokenomics or team

- No utility: Pure speculation without use cases

📚 Resources for Learning More

- Token Economics Guides: Comprehensive tutorials and best practices

- Market Analysis Tools: Charts, metrics, and analytics platforms

- Community Forums: Discussions with other token creators and investors

- Expert Consultations: Professional advice for token design

- Case Studies: Analysis of successful and failed token launches