🎯 Token Launch Guide

This comprehensive guide will walk you through the complete process of creating and launching your token on POTLAUNCH, from initial setup to post-launch management.

🚀 Step-by-Step Token Creation Process

Step 1: Access Token Creator

- Go to POTLAUNCH and click on Token Creator in the navigation bar.

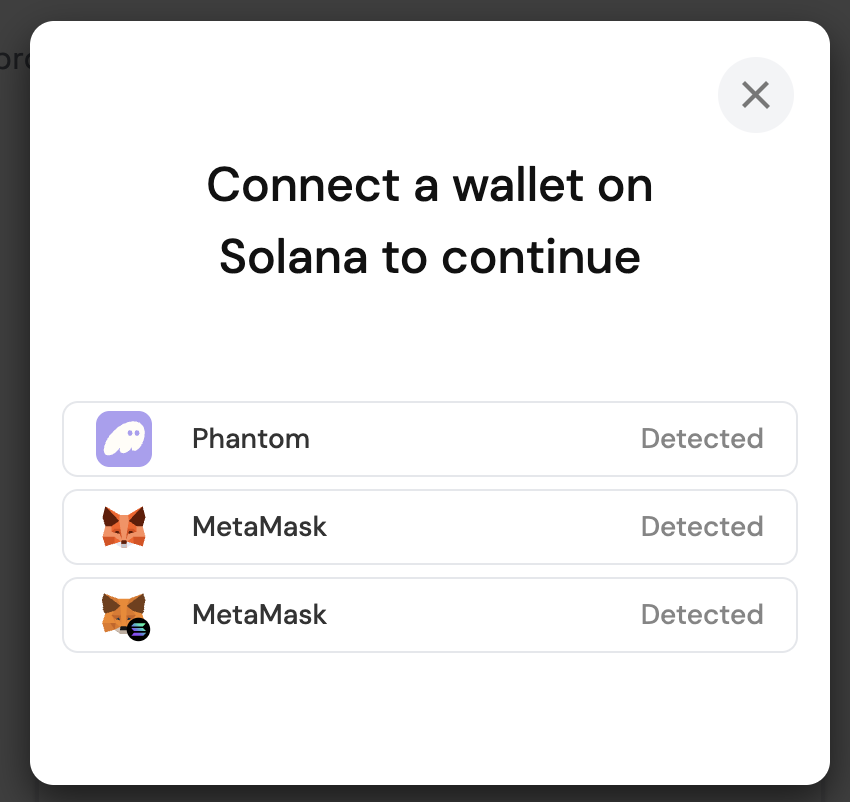

Step 2: Connect Your Wallet

- 🦊 Connect your wallet (Connect Wallet) to interact with the platform.

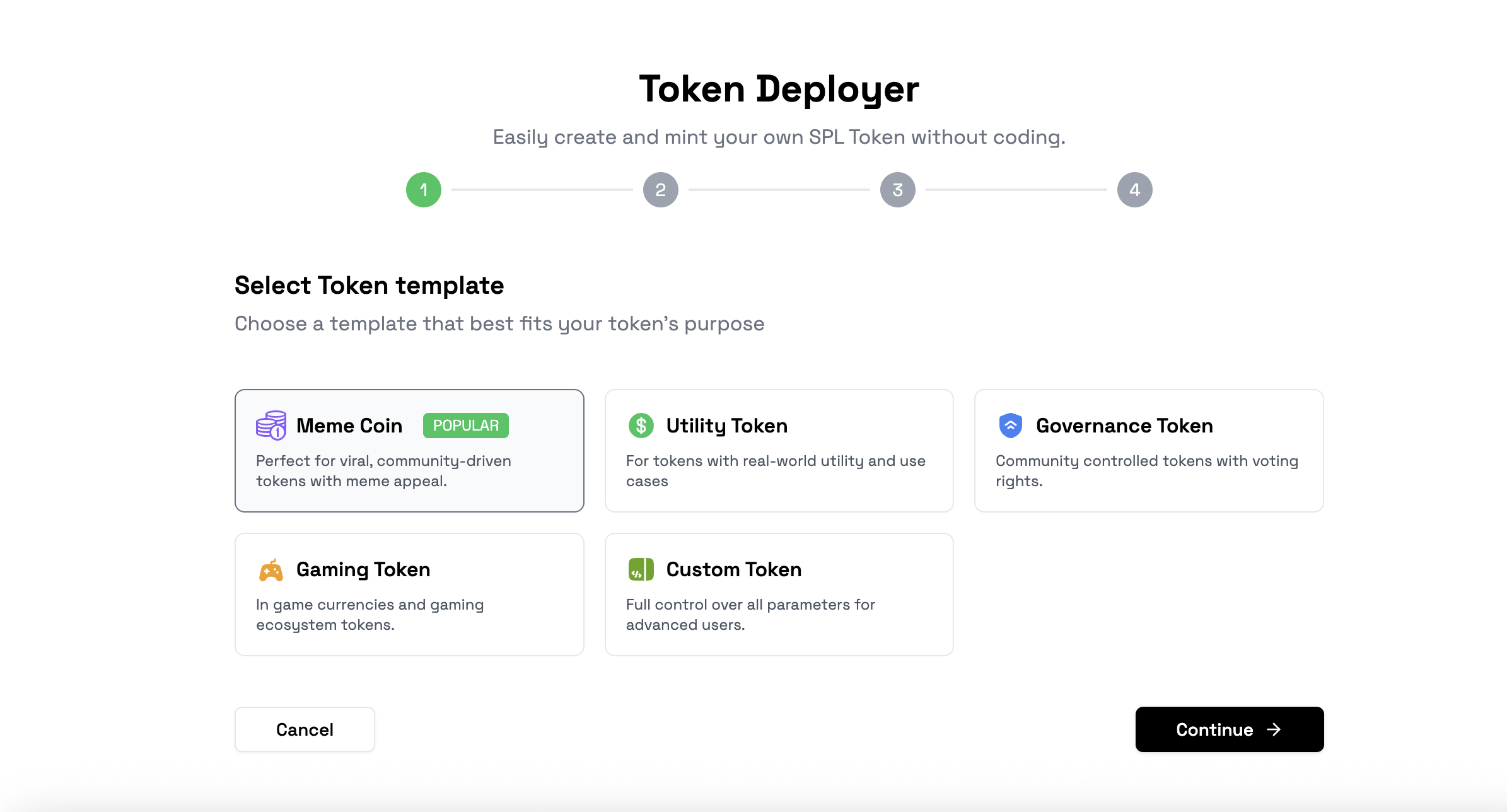

Step 3: Choose Token Template

- 🧩 Select a token template that fits your purpose (meme, governance, utility, etc.).

Step 4: Select Exchange

- 🔄 Select an exchange where you want to list your token.

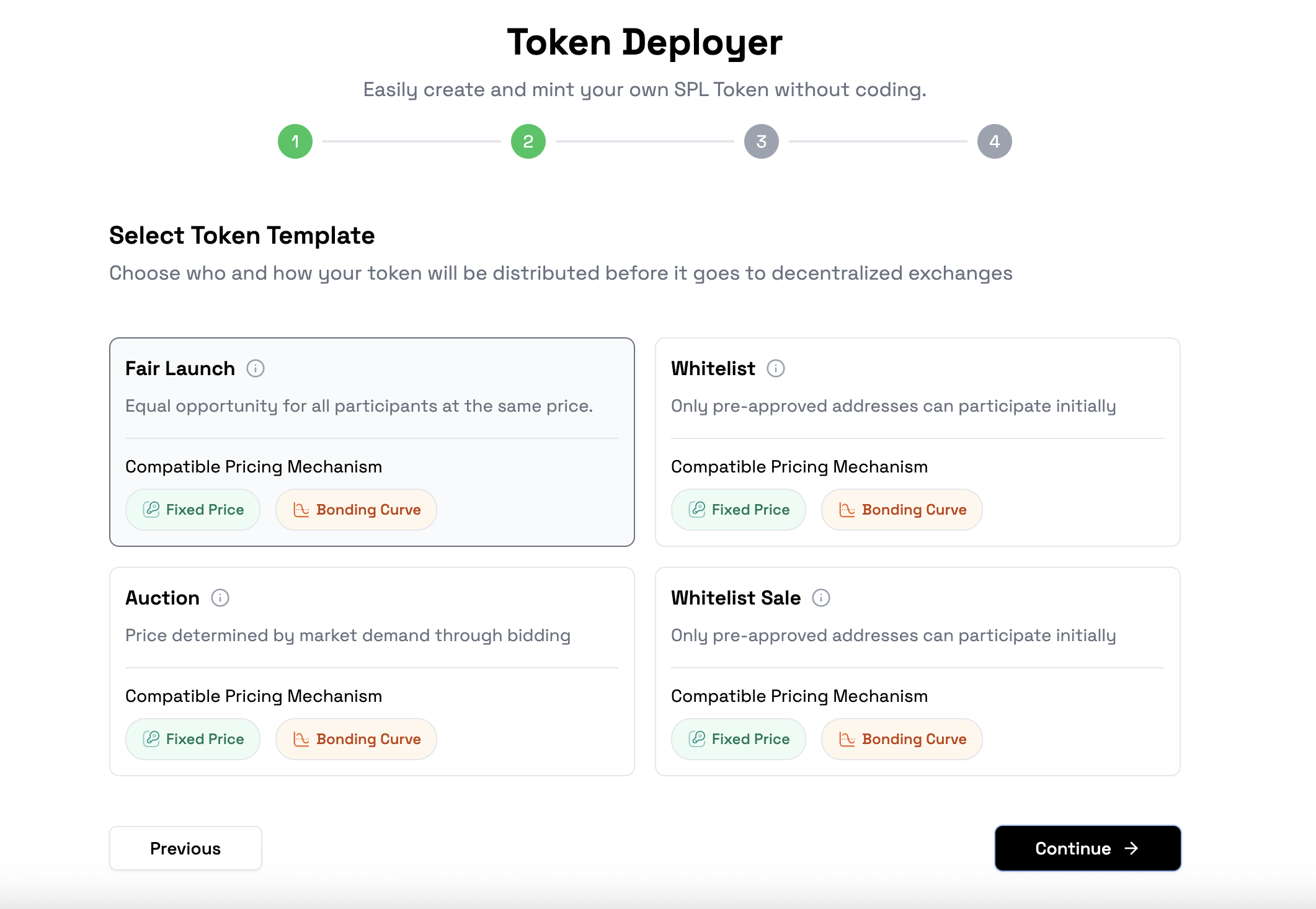

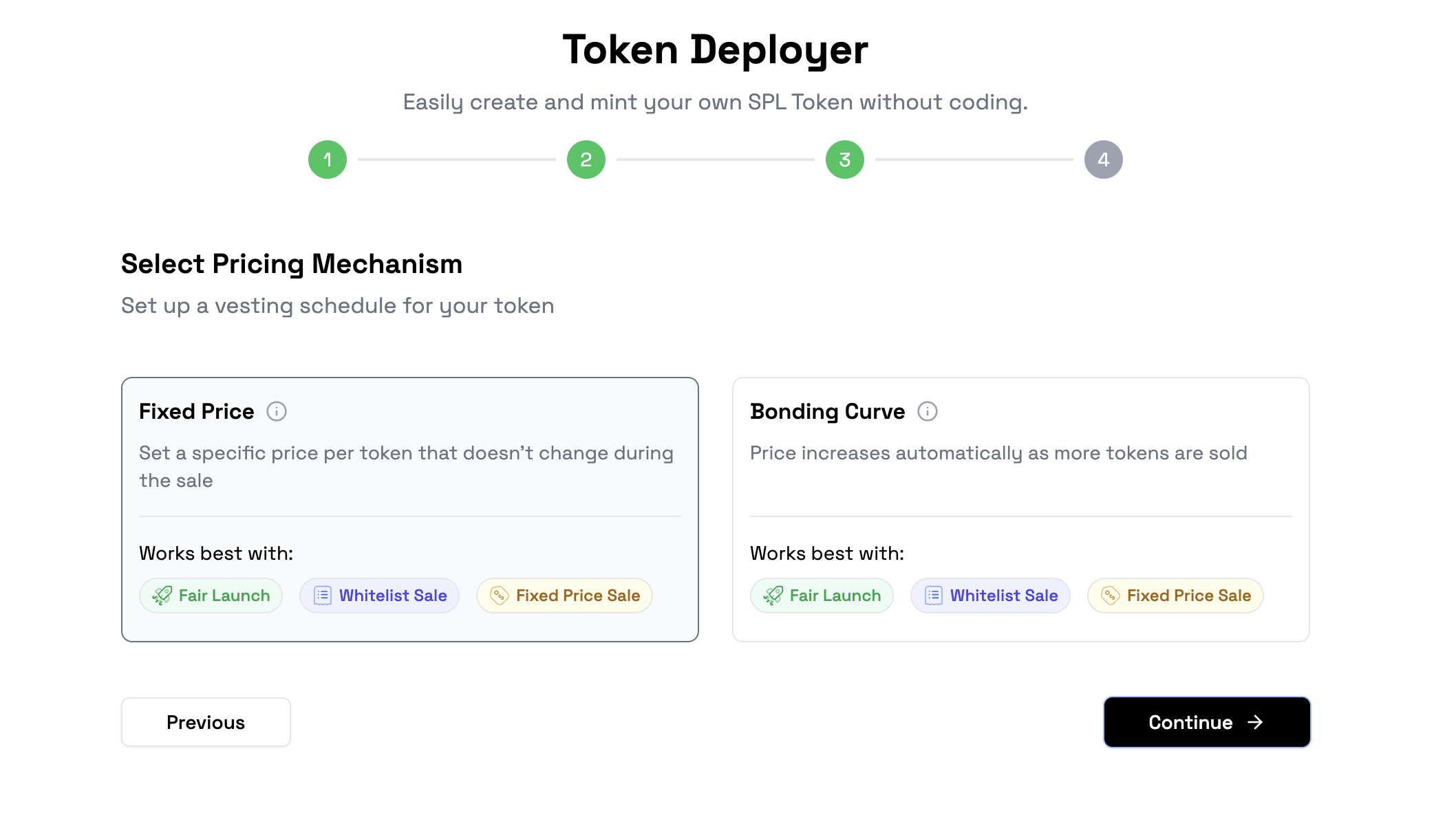

Step 5: Choose Pricing Mechanism

- 💸 Choose a pricing mechanism (Pricing Mechanism) - bonding curve, fixed price, dutch auction, etc.

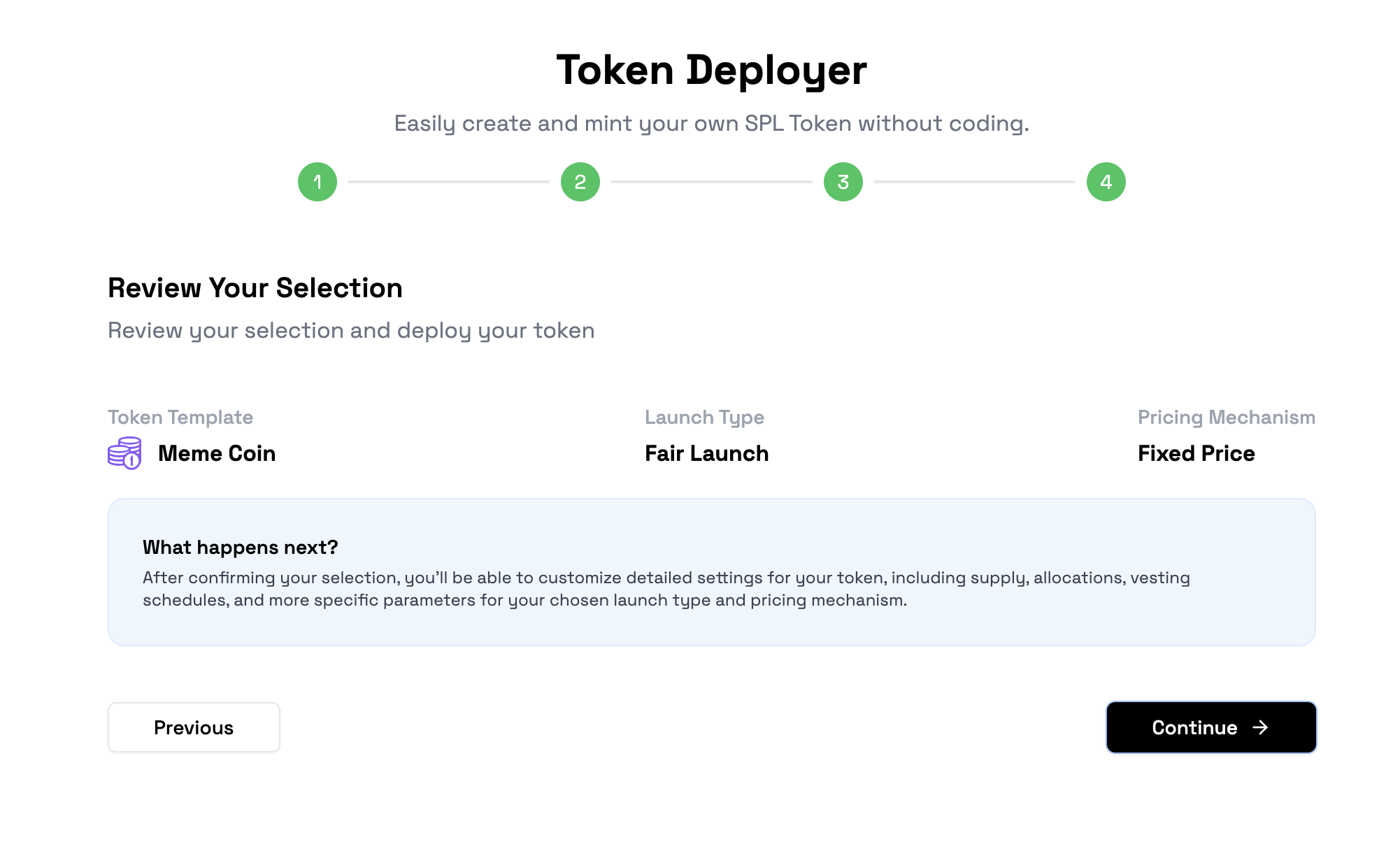

Step 6: Review Your Selection

- 📝 Review your selection (Review Your Selection) to ensure all choices are correct.

📋 Token Configuration

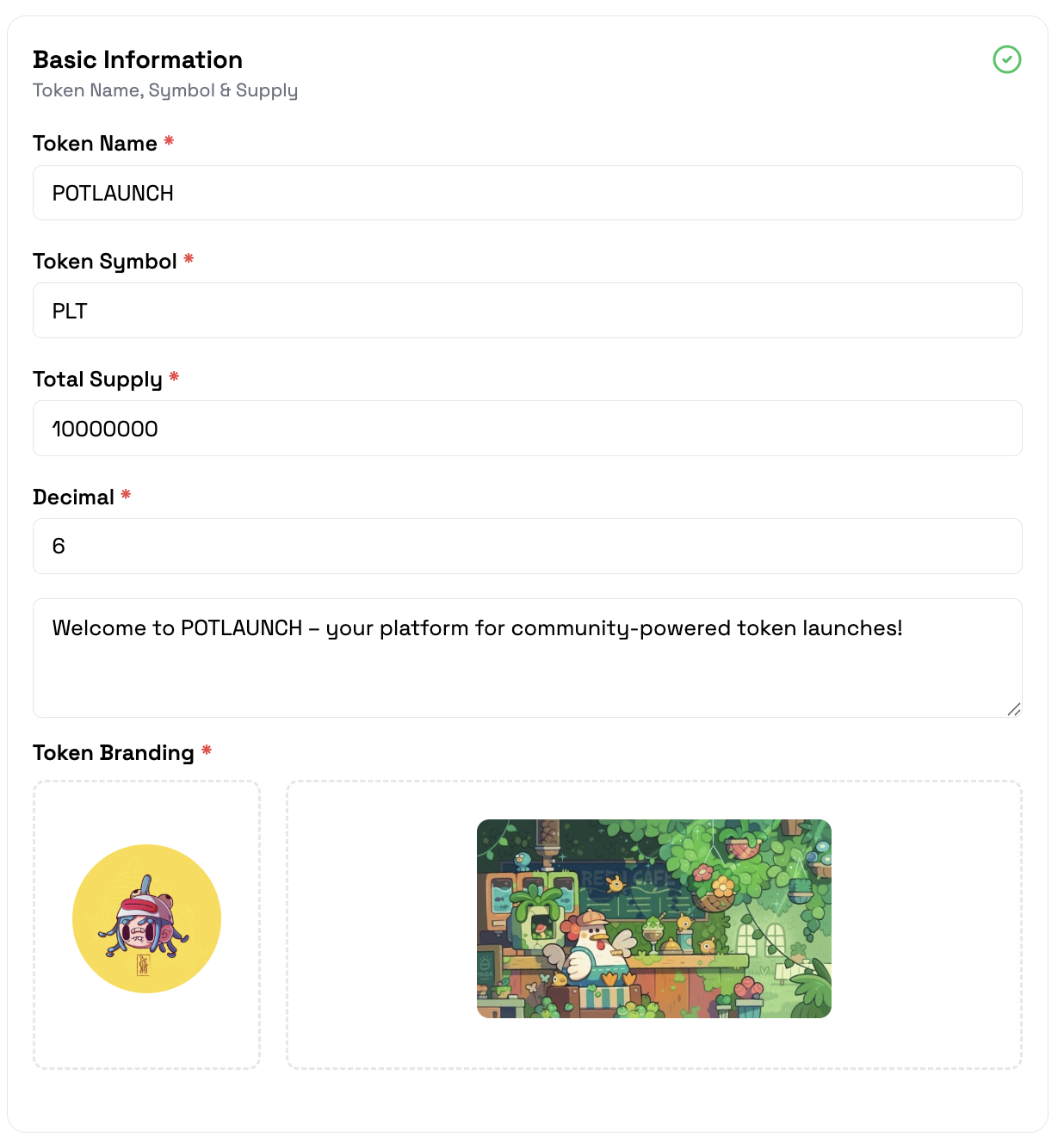

Step 7: Basic Information

- 🏷️ Enter basic information: Name, symbol, total supply, description, logo, banner, etc.

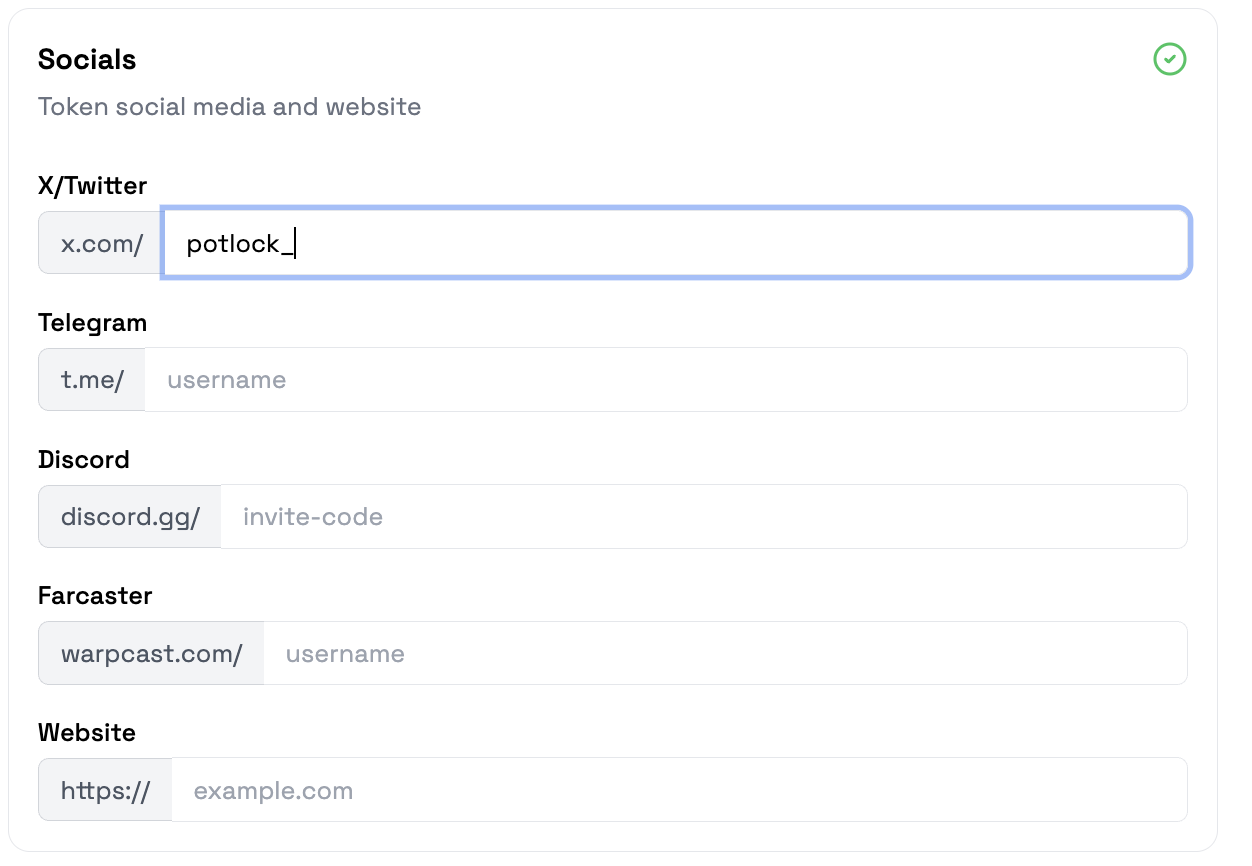

Step 8: Social Links

- 🌐 Add social links: Twitter, Telegram, Discord, Farcaster, Website, etc.

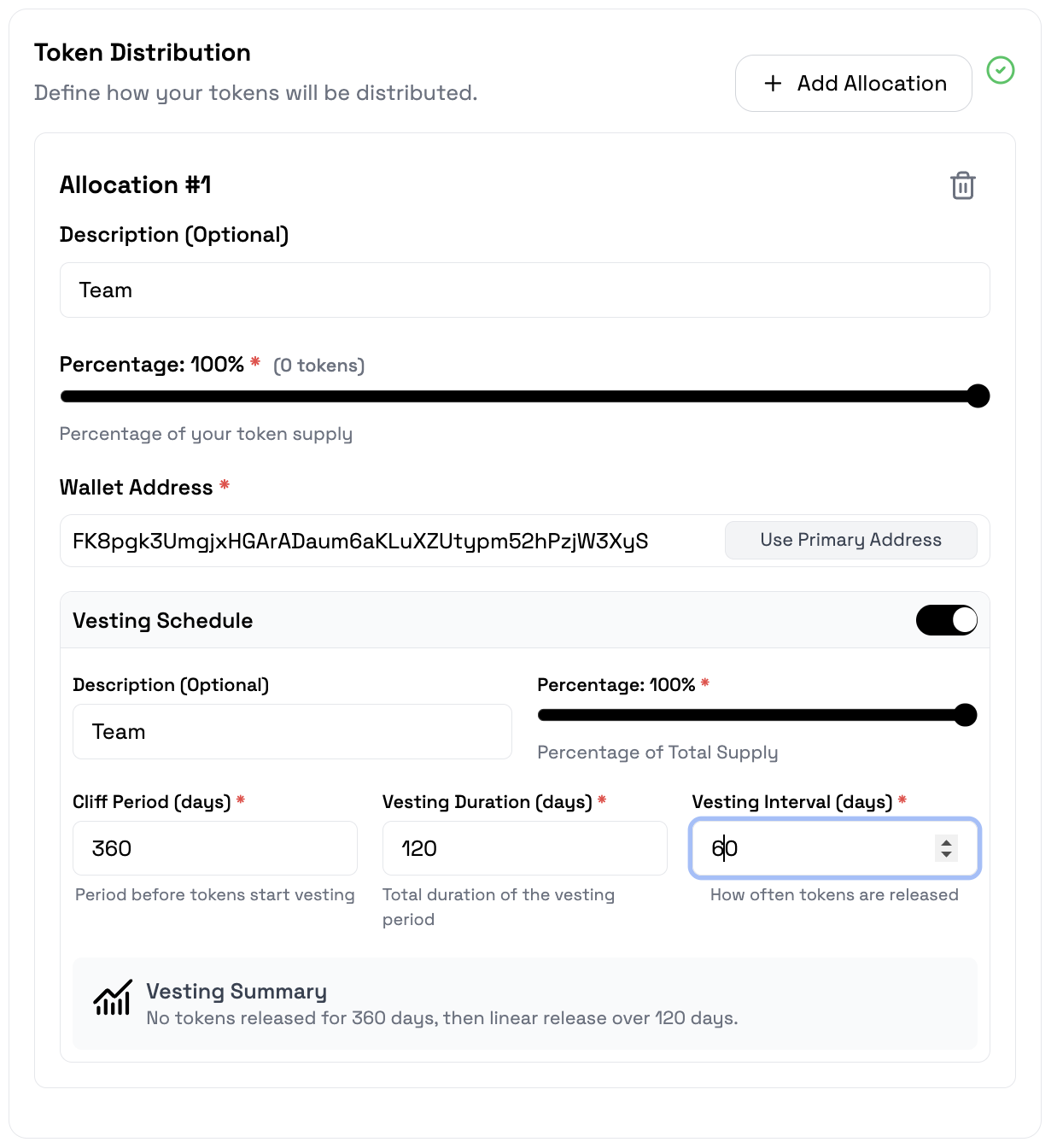

Step 9: Token Distribution

- 🎁 Set up token distribution: Add allocations, vesting if needed.

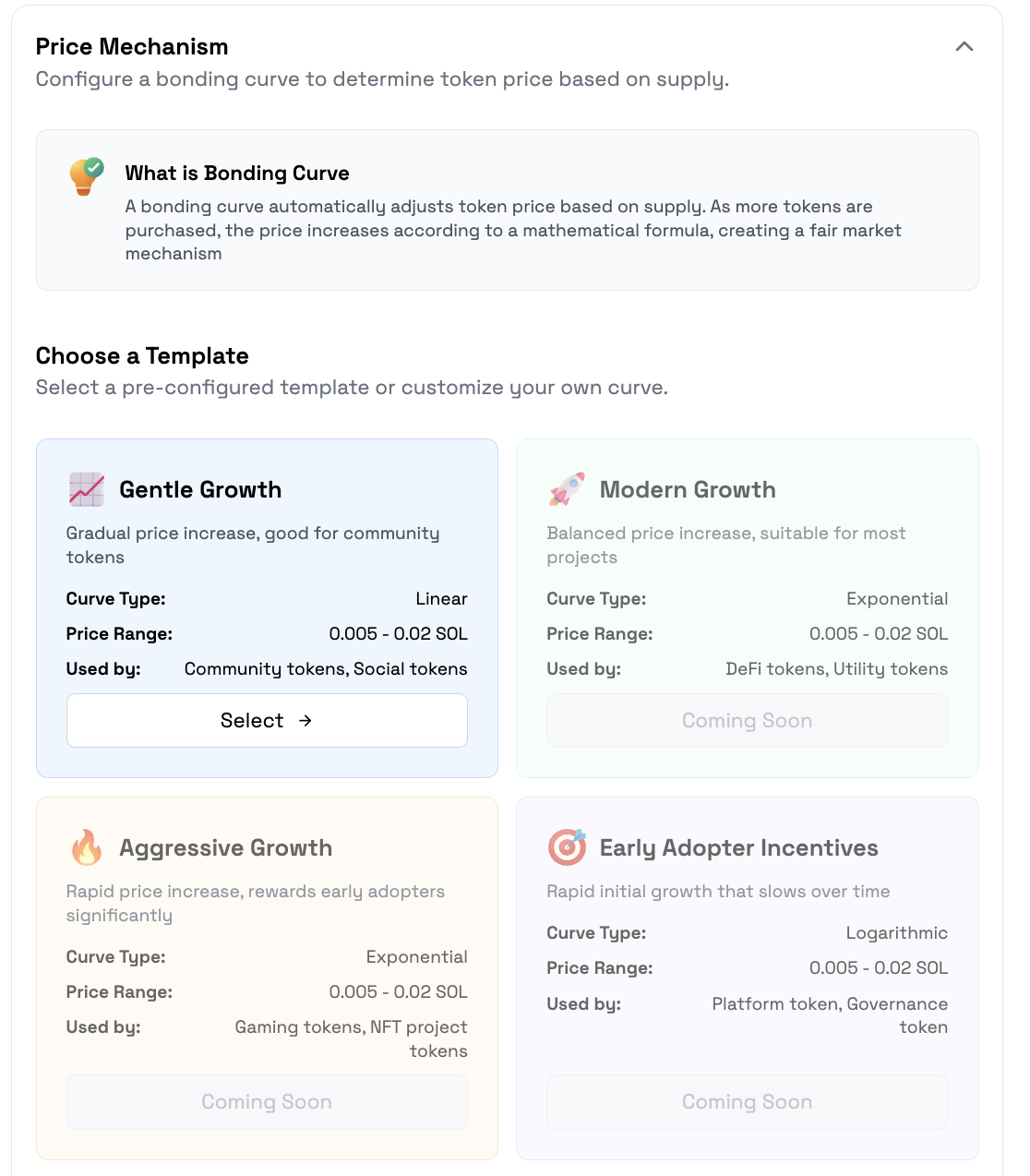

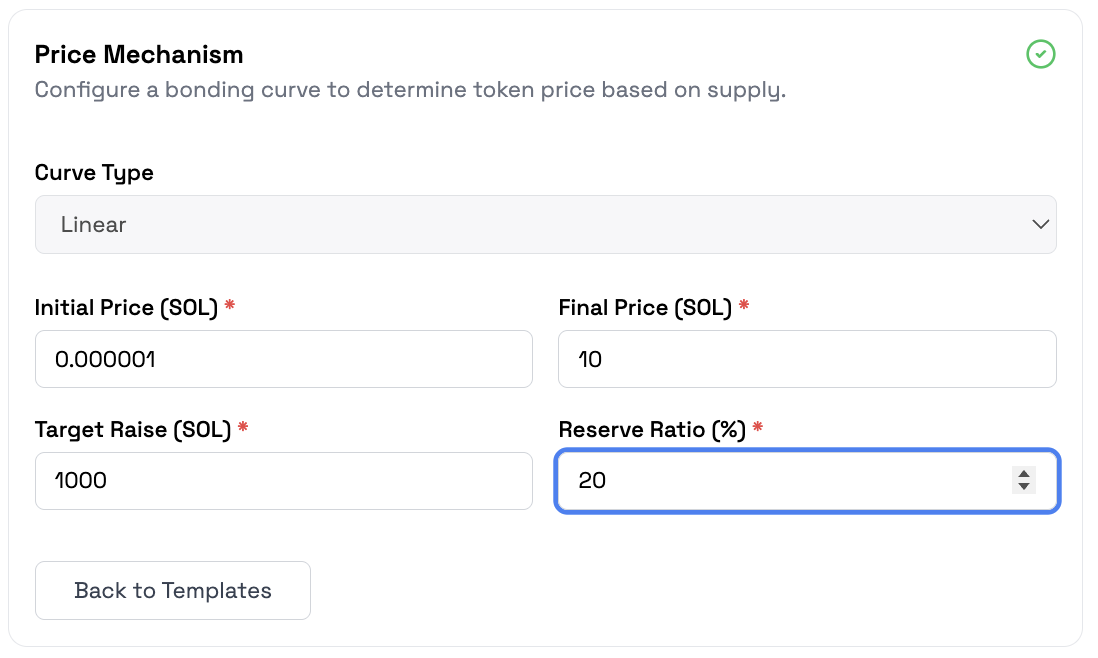

Step 10: Configure Price Mechanism

-

📈 Configure price mechanism: Bonding curve or fixed price.

- Select template price mechanism

- Configure price mechanism

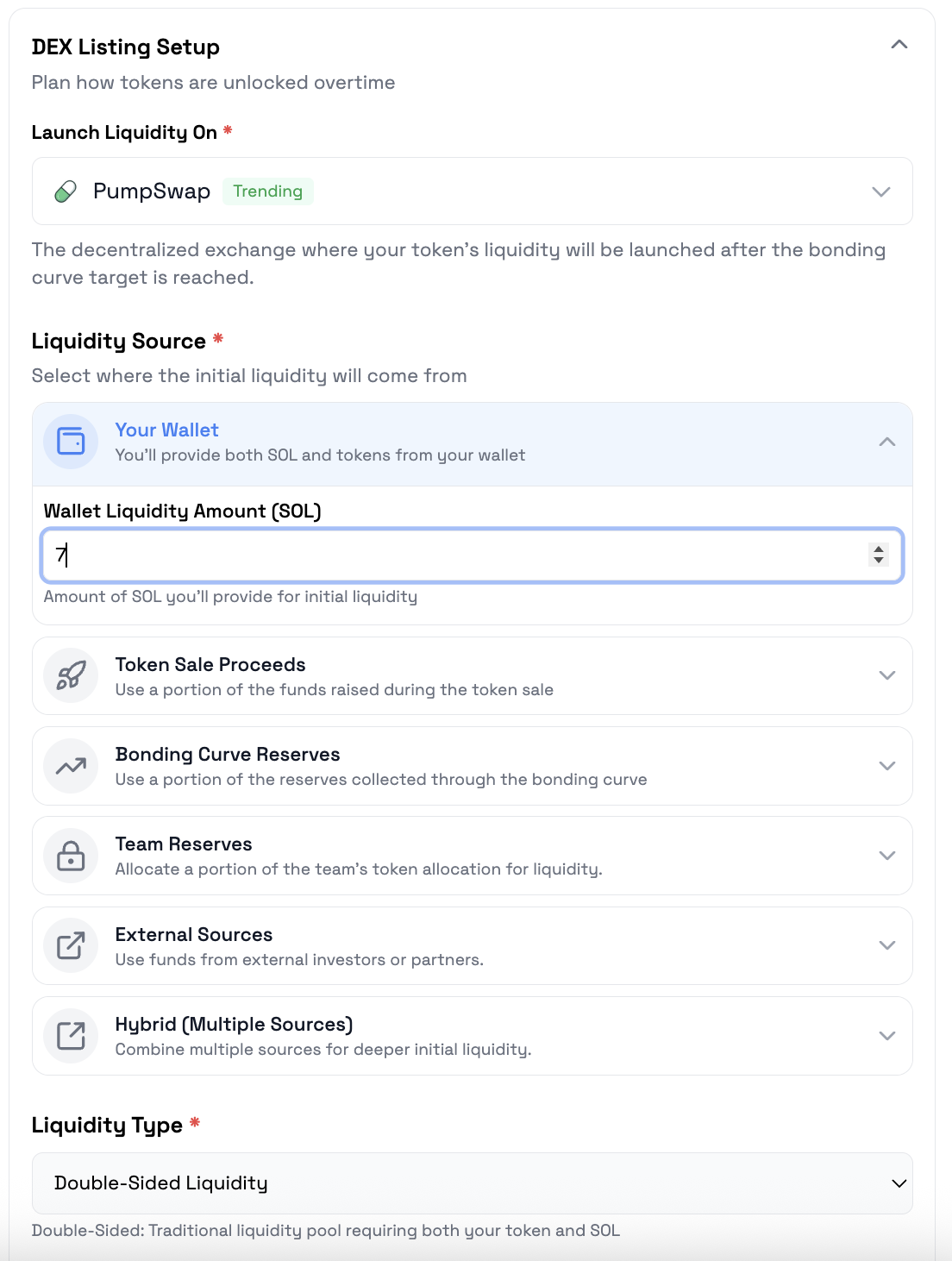

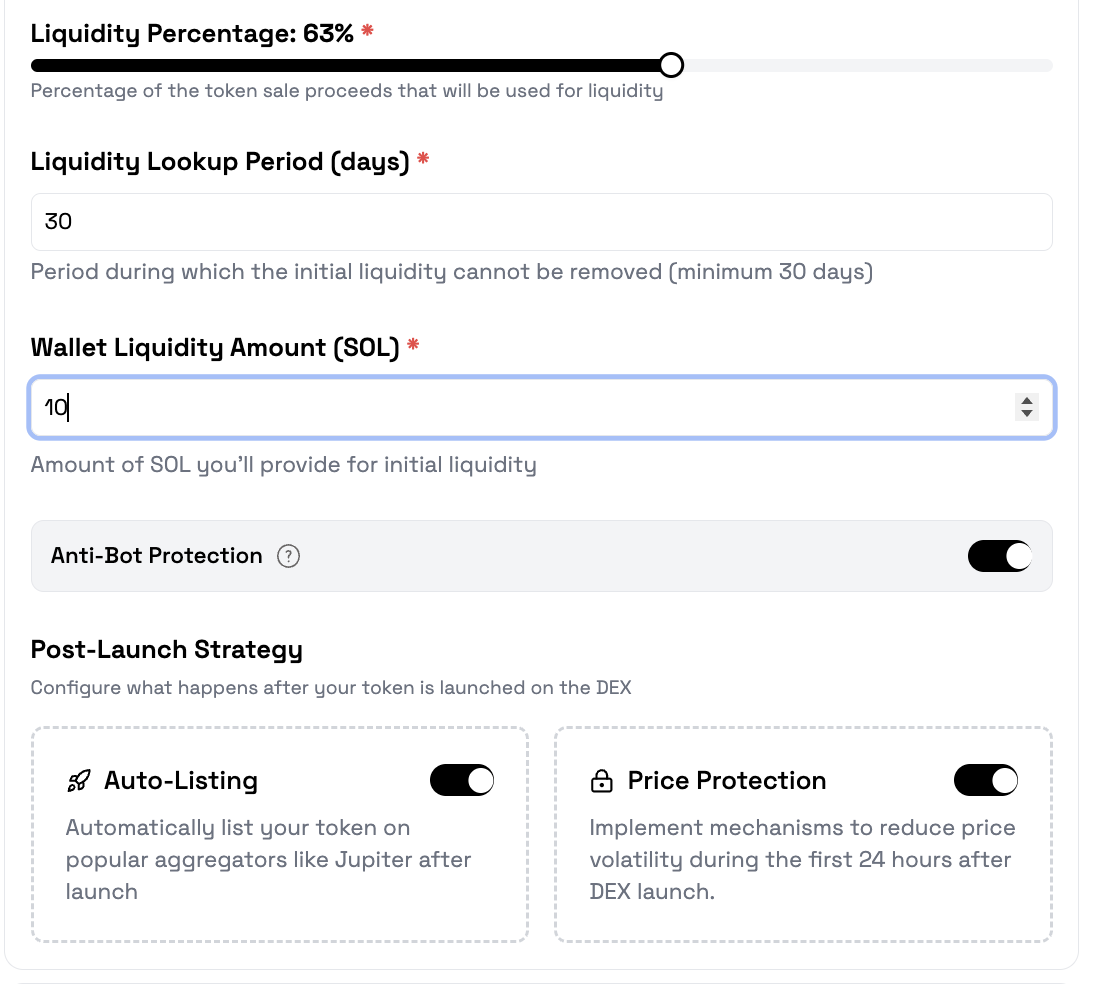

Step 11: DEX Listing Setup

- 💧 Set up DEX listing: Choose DEX, liquidity source, SOL amount, etc.

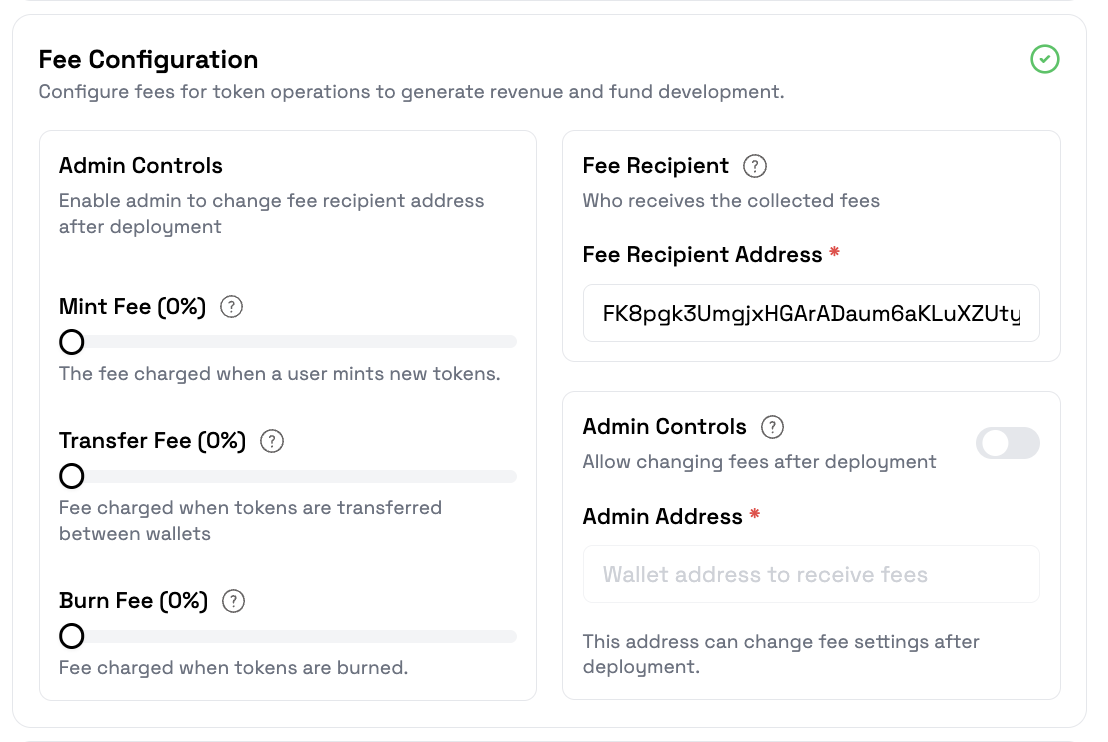

Step 12: Fee Configuration

- 💰 Configure fees: Mint, transfer, burn fees, fee recipient address, etc.

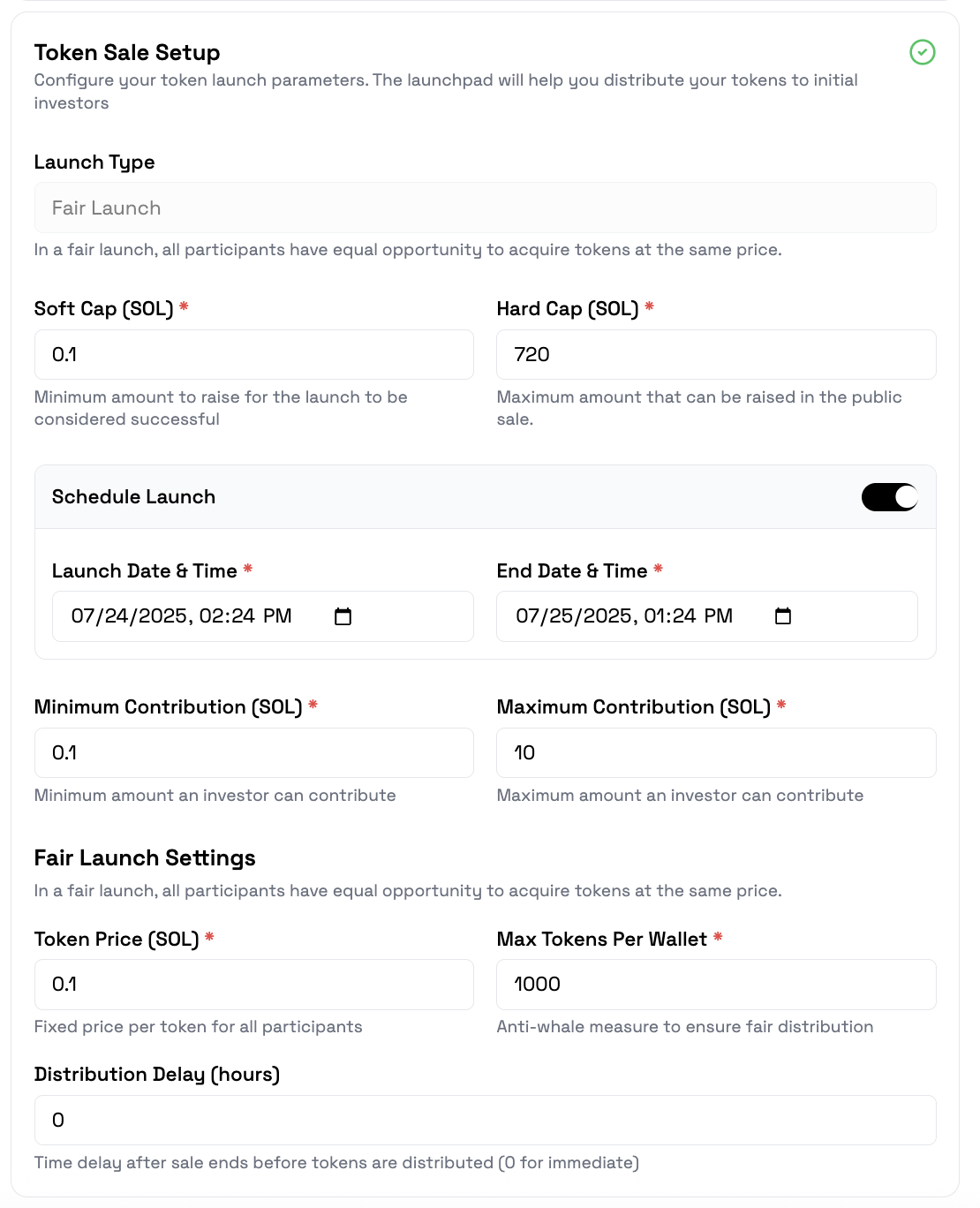

Step 13: Token Sale Setup

- 🚀 Set up token sale: Launch type, soft cap, hard cap, schedule, min/max contribution, etc.

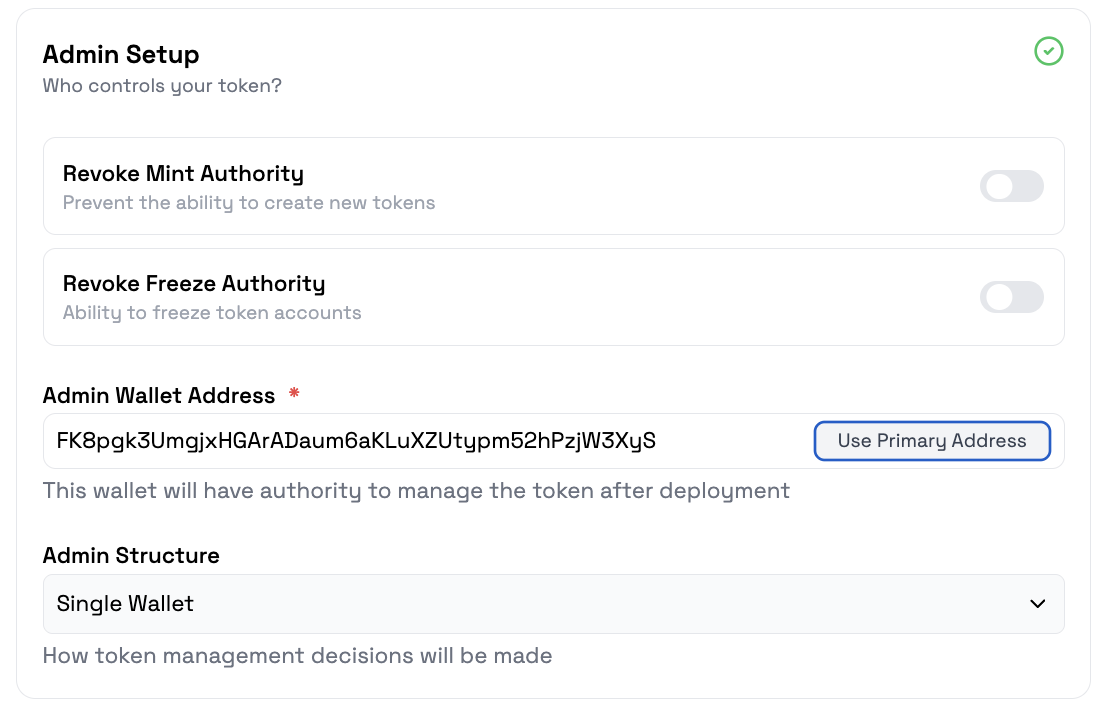

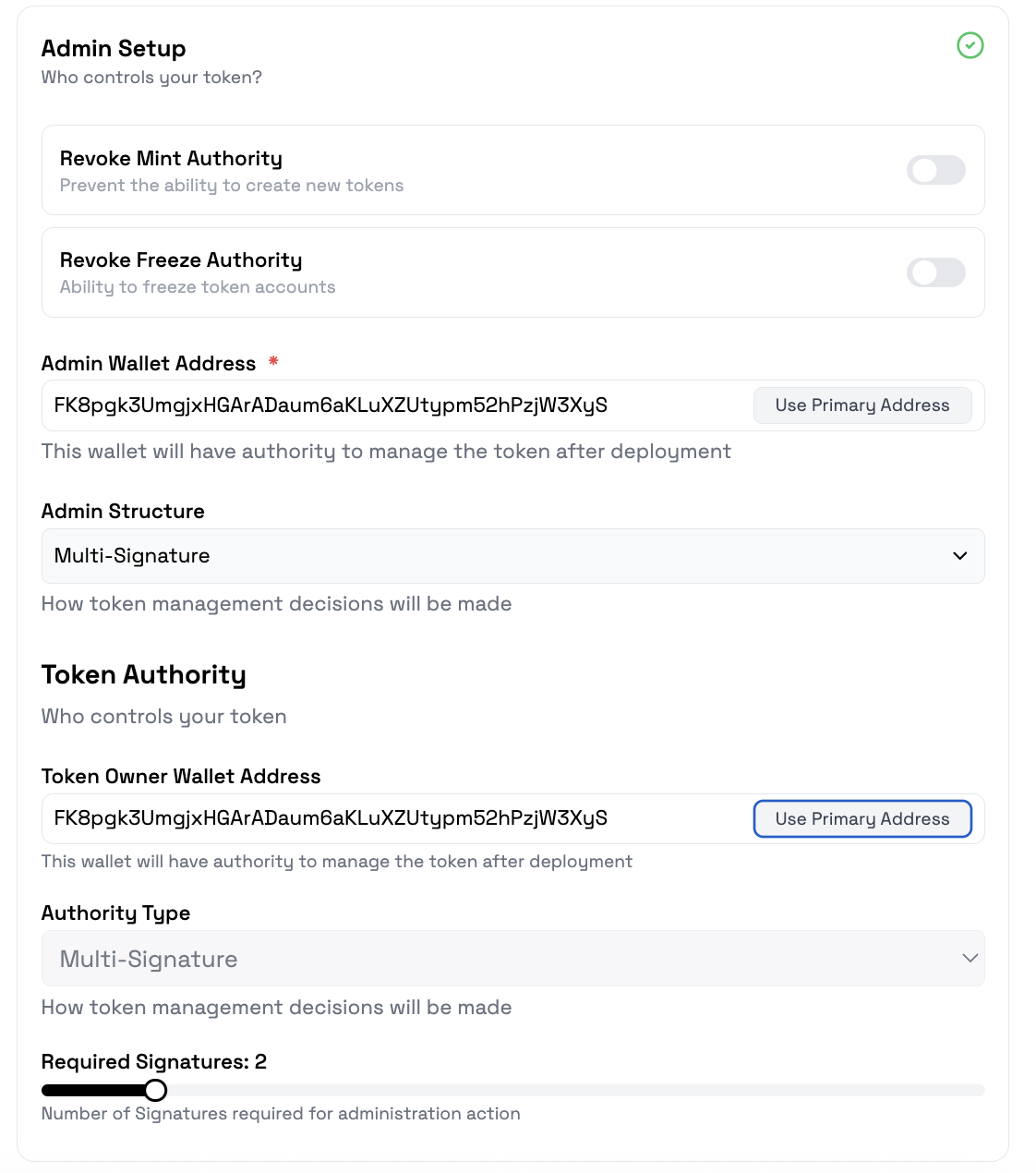

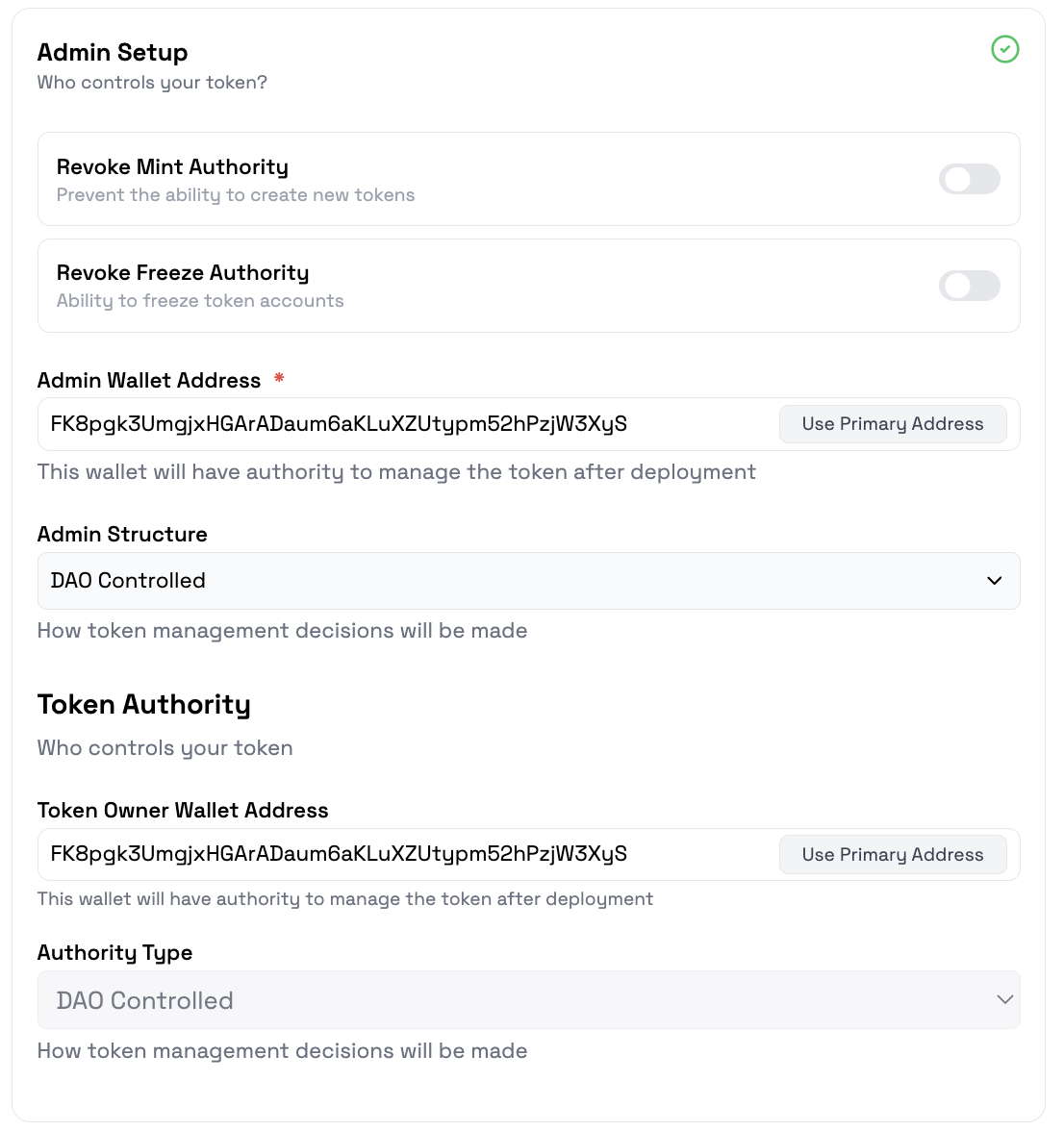

Step 14: Admin Setup

-

🛡️ Admin setup: Admin wallet address, admin structure, revoke mint/freeze authority, etc.

- Admin Structure: Single Wallet

- Admin Structure: Multi Signature

- Admin Structure: Dao Controlled

🚀 Deployment Process

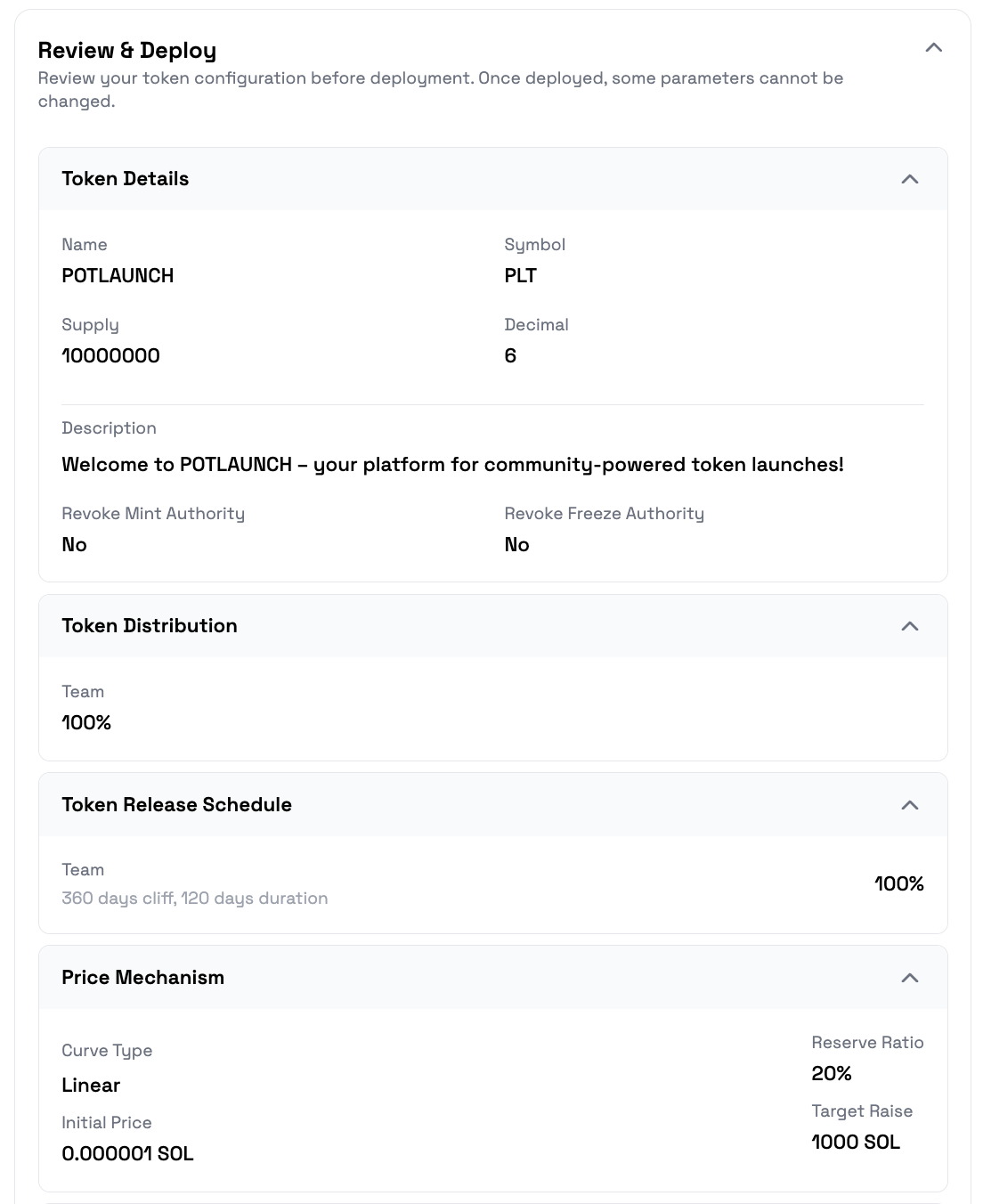

Step 15: Review & Deploy

- 🔍 Review & deploy: Double-check all information before deployment.

Step 16: Deploy Token

-

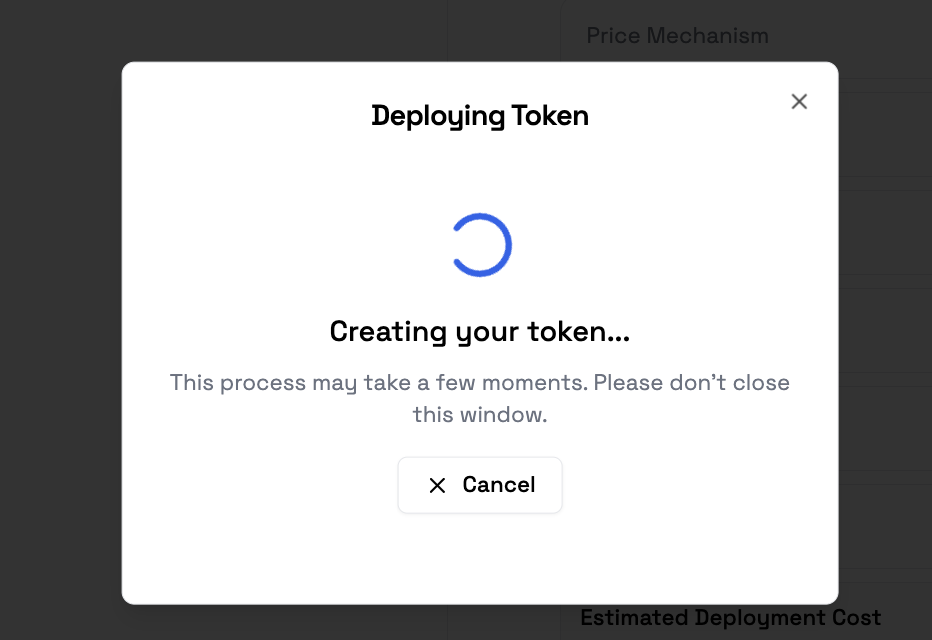

🟢 Deploy Token: Click Deploy to finish creating your token!

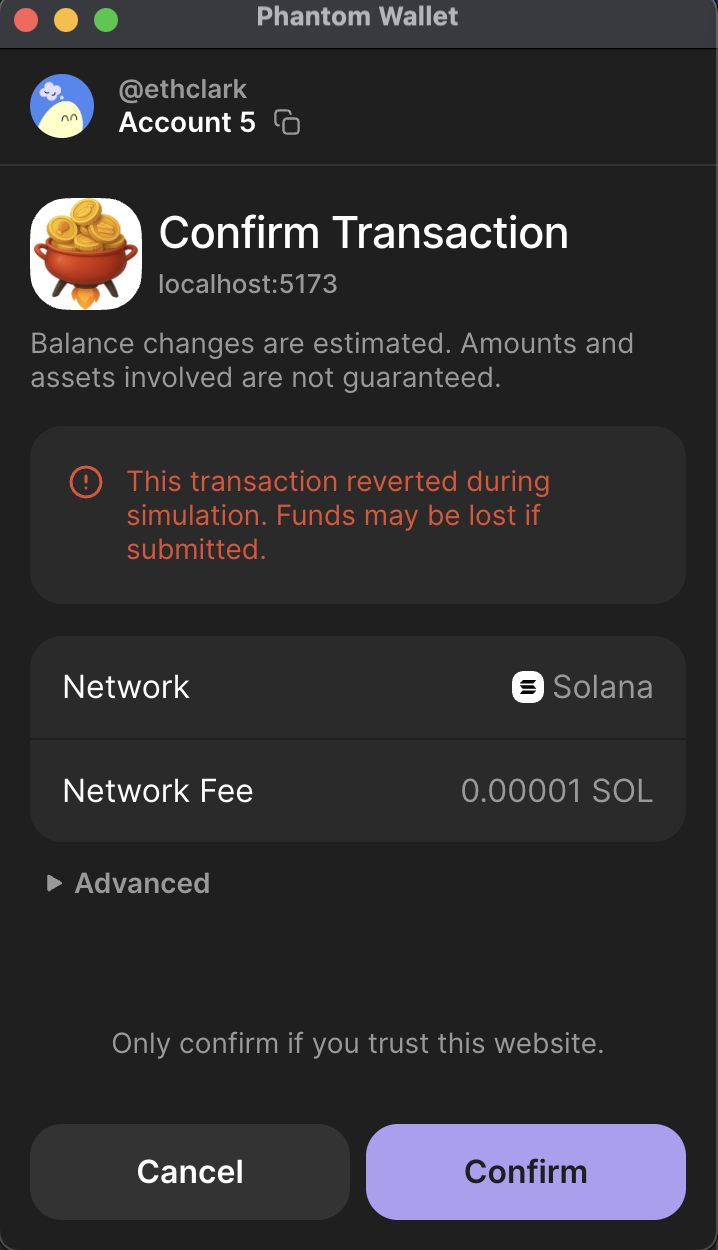

- When you click deploy token, a waiting pop-up like this will appear

- The last step is to confirm the transaction and you have successfully deployed.

📊 Post-Launch Management

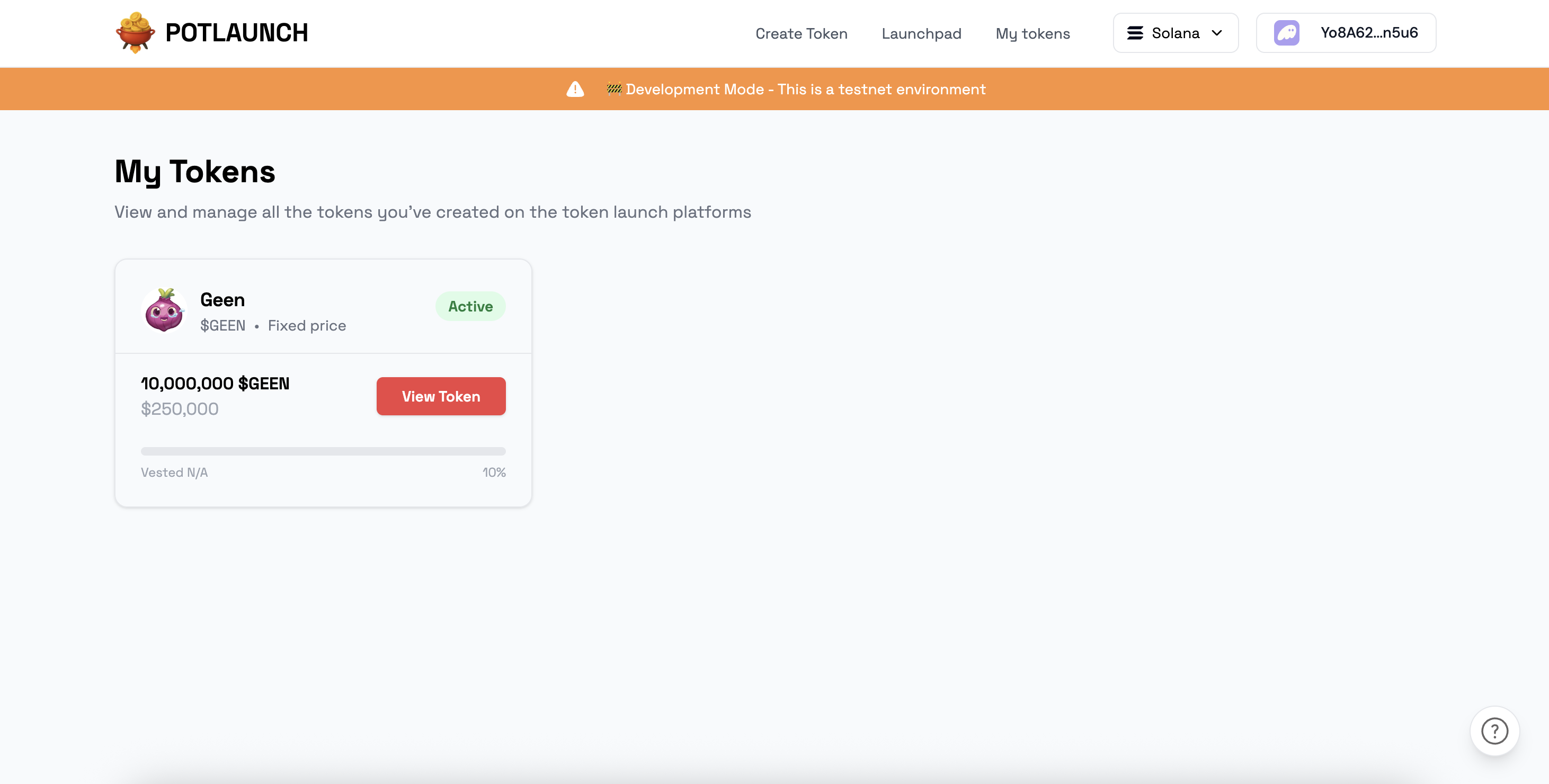

Viewing Your Tokens

- To see the tokens you have created, go to My Tokens.

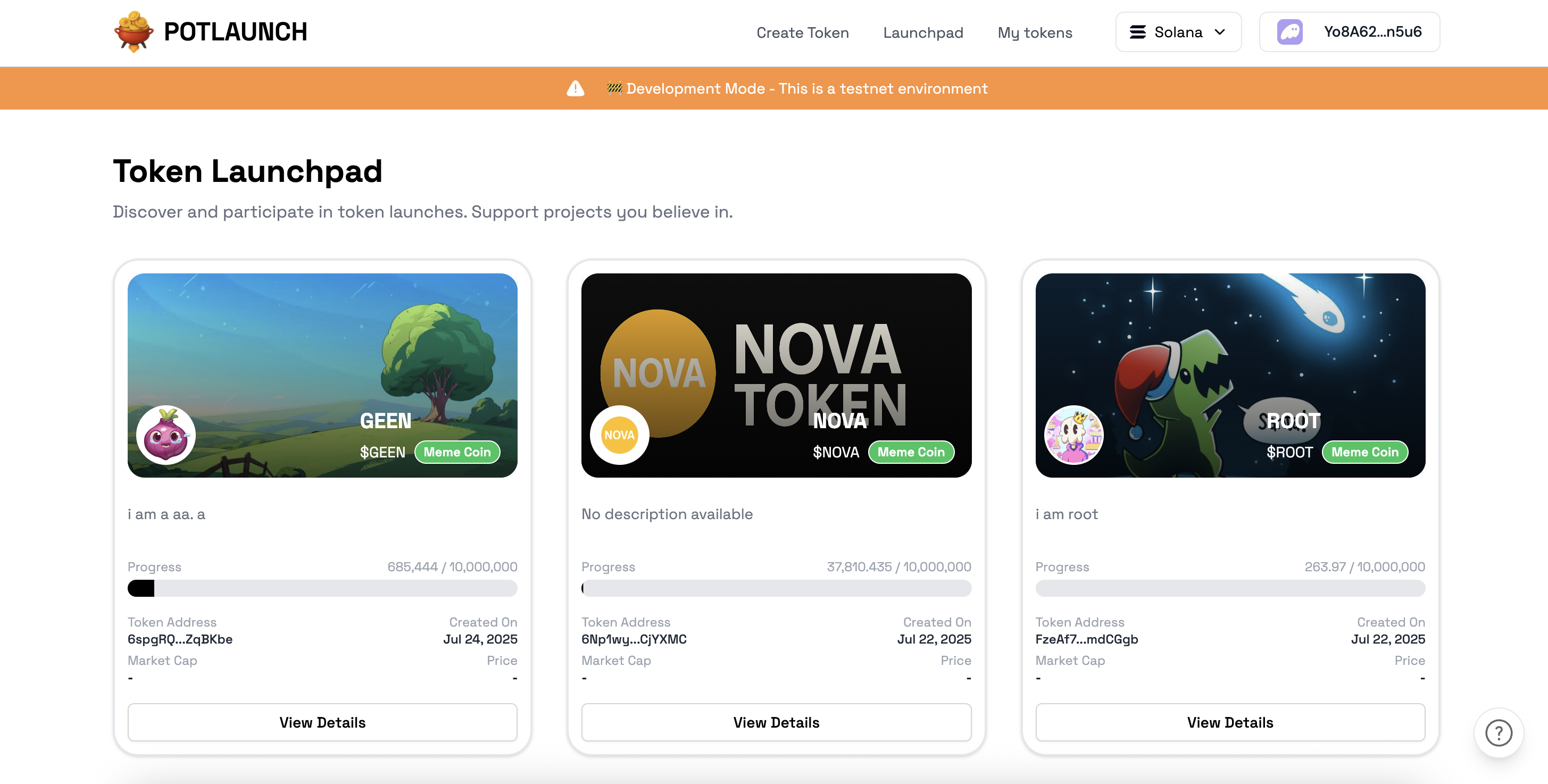

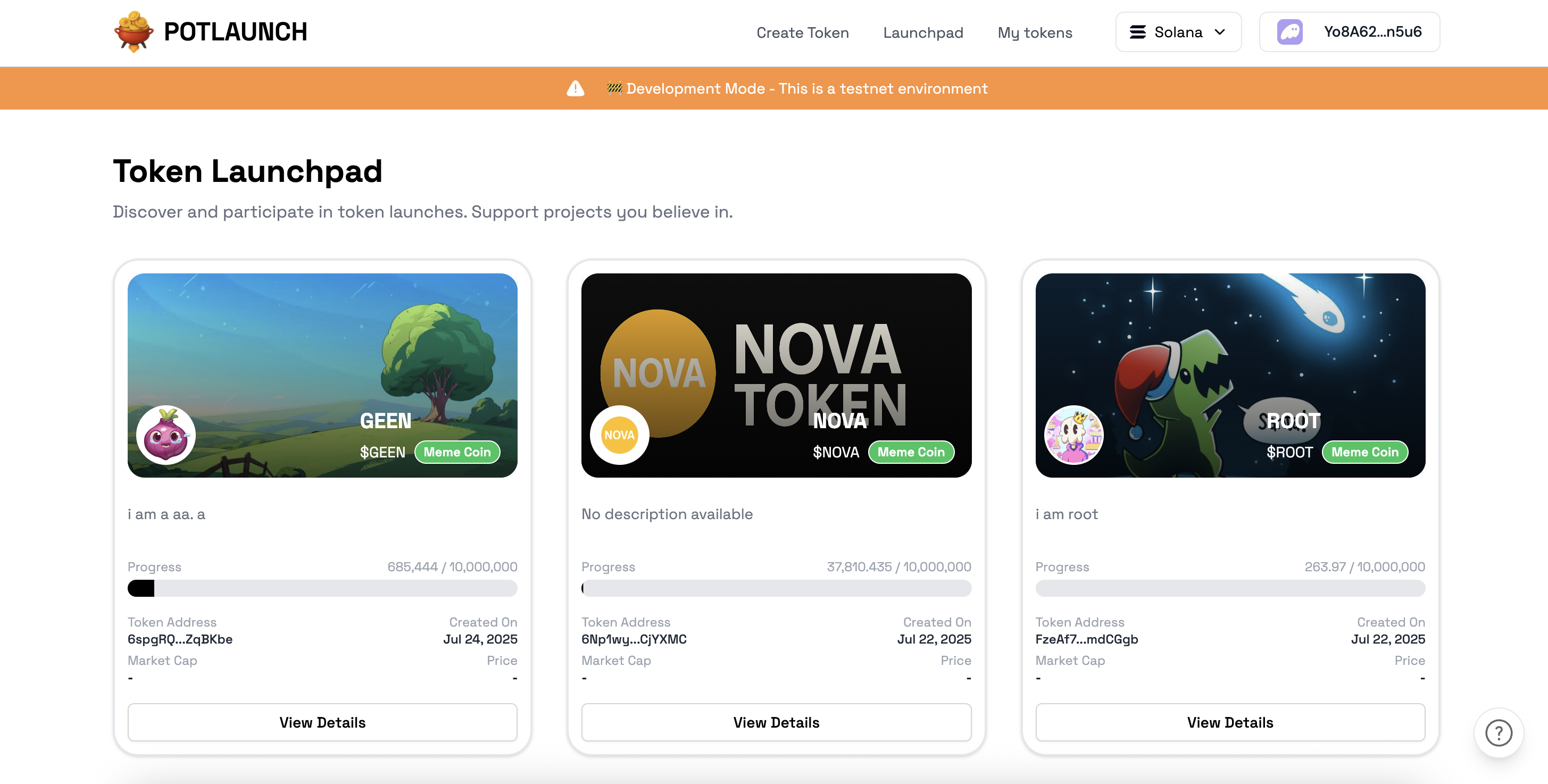

Exploring All Tokens

- To explore all tokens on the platform, visit the Token Launchpad.

💡 Key Considerations for Token Launch

🎯 Choosing the Right Launch Mechanism

Token Template Selection

- Meme Tokens: For community-driven projects with viral potential

- Governance Tokens: For DAOs and decentralized governance

- Utility Tokens: For specific platform or service use cases

- Security Tokens: For regulated financial instruments

Exchange Selection

- Raydium: High liquidity, popular DEX on Solana

- Orca: User-friendly interface, concentrated liquidity

- Jupiter: Aggregator for best prices across DEXs

- Serum: Order book-based trading

Pricing Mechanism Options

- Bonding Curve: Price increases with supply, fair price discovery

- Fixed Price: Stable pricing, predictable for investors

- Dutch Auction: Market-driven pricing, prevents FOMO

- Dynamic Pricing: Adjusts based on market conditions

📈 Tokenomics Best Practices

Supply Distribution

- Team & Advisors: 10-20% with vesting schedules

- Community & Public Sale: 30-50% for fair distribution

- Liquidity: 10-20% for DEX liquidity pools

- Marketing & Development: 5-15% for ongoing operations

- Reserve: 5-10% for future development

Vesting Schedules

- Linear Vesting: Gradual token release over time

- Cliff Vesting: No tokens until specific date

- Milestone Vesting: Based on project achievements

🔧 Technical Configuration

Fee Structure

- Mint Fees: Charged when new tokens are created

- Transfer Fees: Applied to token transfers

- Burn Fees: Fees for token burning operations

- Fee Recipients: Addresses receiving collected fees

Admin Controls

- Single Wallet: Simple, single admin control

- Multi-Signature: Enhanced security with multiple signers

- DAO Controlled: Community governance over admin functions

🛡️ Security Considerations

Pre-Launch Security

- Smart Contract Audit: Professional security review

- Testnet Deployment: Thorough testing before mainnet

- Access Control: Proper admin key management

- Emergency Pauses: Ability to halt operations if needed

Post-Launch Security

- Liquidity Locking: Prevent rug pulls

- Vesting Enforcement: Ensure team tokens are locked

- Regular Monitoring: Track unusual activity

- Community Oversight: Transparent operations

📚 Additional Resources

🔗 Useful Links

📖 Related Guides

- User Guides - Complete platform usage guide

- Bridge & Cross-Chain Features - Multi-chain functionality

- Fair Launch Features - Fair launch mechanisms

⚠️ Important Notes:

- Always double-check all information before deploying

- After your token is launched, some parameters cannot be changed

- Ensure sufficient SOL balance for deployment and liquidity provision

- Consider the long-term sustainability of your tokenomics design

- Engage with your community and maintain transparency throughout the process